US Inflation:The US Consumer Price Index (CPI) for May 2025 showed a year-over-year increase of 2.4%, with core inflation (excluding food and energy) at 2.8%. Both monthly readings came in below expectations, signaling short-term cooling. However, long-term inflation pressures persist, with CPI indices hitting record highs. Markets responded positively, but questions remain about data collection quality and Federal Reserve policy direction.

May US Inflation Data

The latest US Consumer Price Index (CPI) data for May offers a mixed bag for economists, investors, and policymakers. The headline inflation number came in lighter than expected, signaling some short-term cooling, but the broader trend still shows persistent inflationary pressure, especially when viewed through a historical lens.

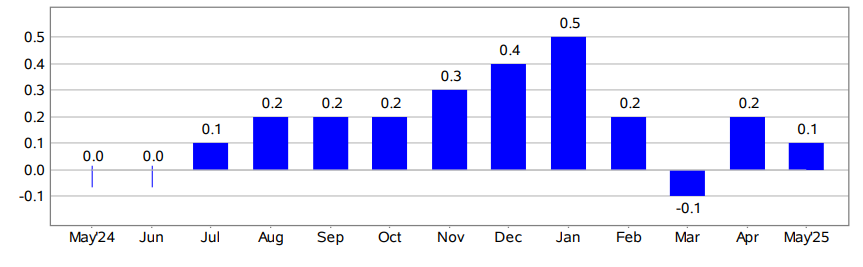

According to the data released, the headline CPI for May rose by just 0.1%, below the 0.2% that markets were expecting. This marks the lightest monthly increase since March 2024, when it registered a 0.1% drop. Stripping out the volatile food and energy components, the core CPI also rose by only 0.1%, which is 0.2% lower than expectations and 0.1% below last month’s figure.

On a year-over-year basis, the headline inflation came in at 2.4%, matching expectations and slightly higher than April’s 2.3%. This figure is in line with March’s reading and lower than February’s 2.8%. The core CPI (excluding food and energy) was reported at 2.8% year-over-year, which is again lower than the 2.9% expected. This marks the third consecutive month with a 2.8% annual increase—still far from the Federal Reserve’s 2% inflation target.

Interestingly, while the monthly numbers appear to be cooling, the long-term CPI index levels continue to rise. The headline CPI index now stands at 321.465, the highest ever recorded since the index began in 1913. Meanwhile, the core CPI index (excluding food and energy) reached 326.854, again a record high since that measurement started in 1957.

Market reaction to the softer CPI numbers was swift. Equities showed strong pre-market gains, and bond yields dropped significantly. The 10-year US Treasury yield fell to around 4.44%, down from just under 4.5%, reflecting optimism that the Federal Reserve might lean toward a more dovish policy stance if inflation continues to ease.

However, while some may celebrate the slight cooling, the overall inflationary environment remains elevated. The 2.8% core inflation is still notably above the Fed’s 2% goal. Analysts and commentators are already turning their focus to the next few months, speculating about future inflation trends and whether the current data signals a sustained decline or a temporary dip.

One interesting angle that emerged was concern over the Bureau of Labor Statistics (BLS) and its capability to accurately measure inflation data under current conditions. There is speculation that hiring freezes or funding cutbacks, possibly tied to the current administration’s policies, may be affecting data collection. Questions are being raised about the adequacy of the CPI data methodology and whether limitations in staffing at the BLS could be skewing the results.

Food inflation showed notable movement in May. The food index increased by 0.3%, reversing April’s 0.1% decline. Grocery store prices, captured by the food at home index, also rose 0.3%. Among grocery categories, the index for cereals and bakery products jumped 1.1%, and fruits and vegetables increased 0.3%. The “other food at home” category rebounded with a 0.7% rise, while meats, poultry, fish, and eggs fell 0.4%, led by a sharp 2.7% drop in egg prices. Nonalcoholic beverages declined 0.3%, and dairy products dipped 0.1%. Restaurant prices, reflected in the food away from home index, rose 0.3%, with both full-service and limited-service meals increasing by the same margin.

Looking at the annual changes, food inflation remains persistent. The food at home index rose 2.2% over the past year. Meats, poultry, fish, and eggs surged 6.1% year-over-year, with egg prices alone soaring by 41.5%. Nonalcoholic beverages climbed 3.1%, while dairy products and cereals rose 1.7% and 1.0% respectively. The fruits and vegetables category, however, declined 0.5% year-on-year. The food away from home index increased 3.8% annually, with full-service meals up 4.2% and limited-service meals rising 3.5%.

The energy index provided some relief, declining 1.0% in May after a 0.7% increase in April. Gasoline prices dropped 2.6% for the month, and natural gas prices fell 1.0%. Electricity, on the other hand, rose 0.9%. Over the last 12 months, the energy index is down 3.5%, with gasoline falling 12.0% and fuel oil dropping 8.6%. In contrast, electricity rose 4.5%, and natural gas prices spiked 15.3%.

Core components, which exclude food and energy, also saw relatively muted gains. The overall core index rose 0.1% in May, following a 0.2% increase in April. Shelter costs, a major component, rose 0.3%. Within shelter, owners’ equivalent rent increased by 0.3% and primary rent rose 0.2%. Lodging away from home dipped slightly by 0.1%. The medical care index rose 0.3%, after increasing 0.5% in April. Hospital services were up 0.4%, and prescription drugs rose 0.6%, while physician services declined 0.3%.

Other categories showed mixed movement. The motor vehicle insurance index rose 0.7%, building on a 0.6% rise in April. Household furnishings and operations increased by 0.3%, personal care items went up 0.5%, and education rose 0.3%. On the downside, airline fares dropped sharply by 2.7% following a 2.8% fall in April. Used cars and trucks fell 0.5%, while new vehicles and apparel declined 0.3% and 0.4% respectively.

Over the past year, core inflation indicators continue to reflect structural price increases. The shelter index is up 3.9%, medical care costs have risen 2.5%, and household furnishings are up 2.7%. Notably, motor vehicle insurance has surged 7.0% year-over-year, indicating ongoing cost pressure in the services sector. Recreation also showed a moderate 1.8% rise.

As the inflation picture evolves, attention will remain focused on both the month-to-month data and the longer-term year-over-year figures. While the May CPI report provides some short-term relief, it also underscores how inflation remains an ongoing challenge for the US economy.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice. Readers should consult a qualified advisor before making any economic decisions based on CPI data.