Israel Strikes Iranian South Pars Gas Field:In a dramatic escalation of the Israel-Iran conflict, Israel has directly targeted Iran’s vital South Pars gas field, striking the Phase 14 processing facility and triggering fires that shut down key infrastructure. The attack—impacting two-thirds of Iran’s domestic gas supply—marks the first direct hit on energy infrastructure in the conflict, sending shockwaves through global energy markets and pushing oil prices up by 13% intraday. With Iran already facing power blackouts and economic losses of $250 million daily, the strikes threaten broader regional stability and global energy flows

Israel Strikes Iranian South Pars Gas Field

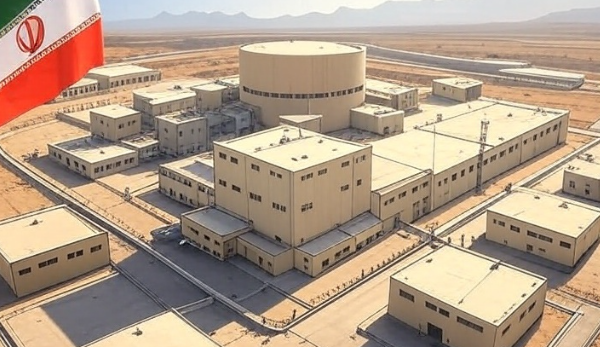

Energy markets are reeling after a high-stakes escalation in the Iran-Israel conflict. For the first time, the confrontation has spilled over into the energy sector, with Israel launching a significant attack on Iran’s most vital gas infrastructure—the South Pars gas field, which Iran shares with Qatar and is considered the largest in the world.

A direct hit was confirmed on Iran’s onshore Phase 14 gas processing facility, which resulted in a massive fire and the forced shutdown of an offshore platform producing nearly 12 million cubic meters of natural gas per day. South Pars is not just an industrial site for Iran—it provides nearly two-thirds of the country’s domestic gas supply, making this a strategic and highly damaging blow to the country’s energy backbone.

This strike marks a dangerous shift in the conflict’s dynamics, being the first clear instance of energy infrastructure being deliberately targeted. The consequences of this are already visible. Just hours after the attack on Phase 14, another fire erupted at Iran’s Fajura Jam gas plant—one of the largest such plants in the nation. Preliminary intelligence suggests the involvement of hostile drones, though Iranian authorities have yet to issue official confirmation.

The timing of these attacks couldn’t be worse for Iran. The country is already grappling with widespread power outages, and the cumulative effect of these new assaults is estimated to be costing Iran’s economy approximately $250 million per day. Analysts have dubbed this the most impactful infrastructure attack since the 2019 Abqaiq strikes on Saudi Arabia’s oil facilities.

Beyond Iran’s borders, the ripple effects are being felt across the global energy sector. Iran’s condensate exports to China and gas exports to neighboring countries like Iraq and Turkey now hang in the balance. In response to the escalating tensions and potential supply disruptions, U.S. crude oil prices surged by as much as 13% intraday on Friday, eventually settling near $73 per barrel.

Although Iran’s limited export infrastructure—including the absence of LNG terminals—may insulate global supply from an immediate crisis, the situation remains highly volatile. The bigger concern is escalation. Roughly one-third of the world’s seaborne oil travels through the surrounding maritime routes, including the Strait of Hormuz, which could be at risk if the conflict widens.

Analysts believe Israel is selecting economic targets with precision, aiming to weaken Iran’s core sectors while avoiding a direct trigger for a global energy crisis. But with tensions running high and both sides on alert, the possibility of miscalculation is dangerously high. The next move could reshape not just the balance of power in the region—but also the dynamics of the global energy market.

For now, the world watches with bated breath as this latest phase of the Israel-Iran conflict continues to unfold.

Disclaimer:

This article is intended solely for informational and educational purposes and does not constitute investment, political, or military advice. The content presented is based on publicly available reports and ongoing developments in a rapidly evolving geopolitical situation involving Israel and Iran. While every effort has been made to ensure accuracy, some details—especially regarding military operations, economic impacts, and strategic assessments—may be subject to change as official confirmations and further updates emerge.

We do not claim independent verification of any military strikes, casualty figures, or infrastructure damage unless confirmed by credible government or international sources. Readers are strongly advised to follow official statements and trusted news organizations for the most up-to-date and accurate information.