Chinese Ports Hit Record Amid Trump Tariffs:China’s export activity has hit a record high as companies rush to ship goods ahead of new US tariffs. In just one week, Chinese ports handled 6.7 million containers—an all-time high—while air and rail freight also surged. The export boom follows a 90-day trade truce with the US, set to expire by mid-August, prompting exporters to move products quickly or reroute them via Southeast Asia. The ripple effects are being felt across Asia, as countries like Vietnam and South Korea also report record shipments to the US.

Chinese Ports Hit Record Amid Trump Tariffs; Handled 6.7 million Containers In Just week

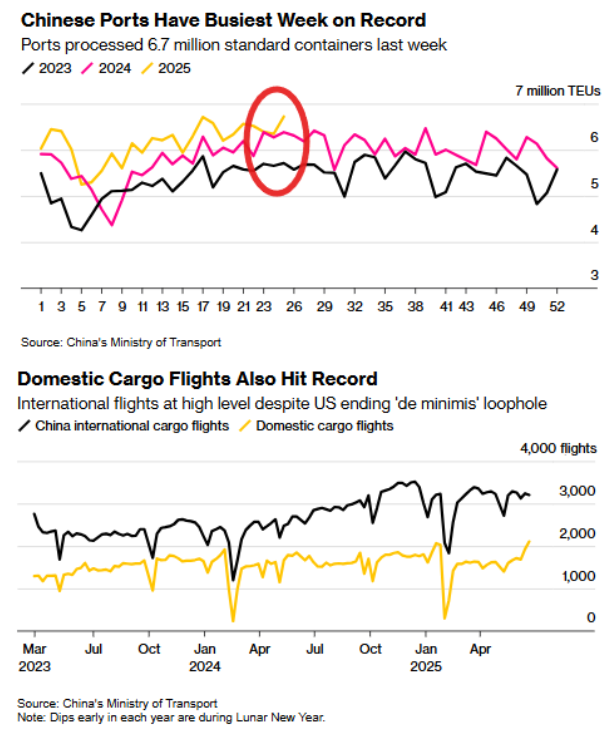

In a dramatic display of economic urgency, China’s export engines are running at full throttle. In just one week, Chinese ports processed a staggering 6.7 million containers, marking the busiest week ever recorded and setting a new national benchmark. This surge, representing a 6% increase from the previous week, underscores how exporters are racing against the clock to ship goods before a fresh round of US tariffs takes effect.

The root cause of this shipping frenzy traces back to the 90-day trade truce that was signed between Beijing and Washington on May 12. This temporary reprieve gave Chinese companies a narrow window to move inventory out of the country and into American markets without facing higher tariffs.

However, with the truce set to expire by mid-August and new tariffs potentially being reimposed as early as next week, Chinese exporters are operating in a pressure-cooker environment.

To meet demand, China’s vast logistics infrastructure is functioning at full capacity. From seaports to airstrips, every node in the supply chain is under strain. According to China’s Ministry of Transport, the 6.7 million containers handled last week represent a historic high.

But the rush isn’t limited to ocean freight alone. China’s air cargo traffic has also surged—more than 2,100 domestic air cargo flights were launched last week, the highest number ever recorded in a single week. International cargo flights also remained robust, exceeding 3,000 flights per week despite the United States ending its de minimis exemption for small parcels.

Rail freight too has hit a seasonal record, further highlighting Beijing’s all-out logistics push to beat the tariff clock. Shippers are not just targeting direct exports to the US; many are rerouting goods through Southeast Asian countries like Vietnam and Thailand in a strategic effort to bypass the impending tariffs.

The graph indicates that in 2025, the number of containers processed surged significantly in the 24th week of the year, surpassing levels seen in the same week during 2023 and 2024. The spike in activity is clear, with the yellow 2025 line rising sharply above the pink and black lines representing the previous two years.

The pressure on China’s export infrastructure is not limited to sea ports. Air freight operations also hit new highs. Domestic cargo flights reached record levels, with more than 2,100 flights taking off in a single week. This is the highest number ever recorded. Meanwhile, international cargo flights remained at elevated levels, staying above 3,000 flights per week, despite the United States ending its ‘de minimis’ loophole, which previously allowed low-value shipments to enter the US duty-free.

The chart illustrates consistent growth in both domestic and international air cargo traffic since early 2023, with minor seasonal dips during the Lunar New Year. Despite these dips, the overall trend points to increased air freight movement, particularly in 2025, where both black and yellow lines representing international and domestic flights respectively show a strong upward movement toward record-setting levels.

These figures reflect the intensity and scale of China’s logistics network, highlighting how sea and air cargo services are both operating at peak capacity amid rising global trade pressures.

This export race is also creating ripple effects across Asia. According to a Bloomberg report, countries such as South Korea, Taiwan, Vietnam, and Thailand all recorded unprecedented shipment volumes to the US last month. The common thread among these nations is clear: move as much inventory as possible before President Trump’s new tariffs take hold.

As July approaches and the trade truce nears its end, businesses on both sides of the Pacific are bracing for impact. While China’s record-breaking shipping week underscores its logistical might, the world is now watching closely to see whether this is merely a short-lived sprint—or the calm before a much more turbulent storm in global trade.

Disclaimer: This article is based on current developments and available reports as of June 2025. The situation may evolve as trade policies and geopolitical dynamics change.