US Trade Surges Amid Soaring Uncertainty Over Trade Policy:Rising trade policy uncertainty in the U.S. has led to a selective surge in imports, particularly from Switzerland. The spike is driven by massive gold imports, reflecting investor and business strategies to hedge against potential disruptions.

US Trade Surges Amid Soaring Uncertainty Over Trade Policy, Gold Imports From Switzerland Lead the Spike

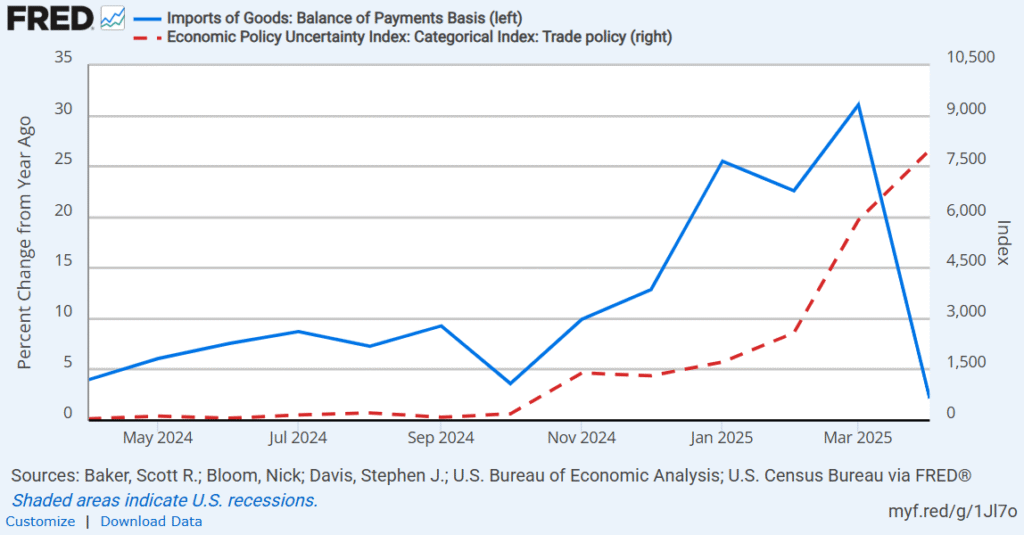

In recent months, the United States has seen a noticeable surge in imports, coinciding with a sharp rise in trade policy uncertainty. This shift reflects how businesses and investors are reacting to growing concerns over future trade regulations, tariff changes, or geopolitical instability. As trade policy uncertainty began escalating in late 2024 and continued into early 2025, importers appeared to respond by accelerating their purchasing activities.

The percentage change in U.S. imports of goods rose steadily from May 2024 to March 2025. The increase was especially sharp starting in late 2024, peaking in March 2025 before dropping drastically. This spike in imports aligns closely with the timing of a sharp upward movement in the Economic Policy Uncertainty Index specific to trade policy, which also began climbing rapidly during the same period. The correlation suggests that businesses were likely trying to get ahead of potential disruptions by stocking up in advance.

A closer look at the regional origins of these imports shows important distinctions. While imports from China, Canada, Mexico, Asia, and the world as a whole showed modest year-over-year growth, imports from Europe stood out for their disproportionately large increase. The percentage growth in imports from Europe significantly outpaced other regions, especially during the first quarter of 2025. This regional disparity raises the question: what was driving the surge in European imports?

A deeper breakdown of European trade reveals that Switzerland was the primary driver behind the continent’s export increase to the United States. While imports from Germany, France, the United Kingdom, and other European nations showed relatively minor year-over-year changes, imports from Switzerland climbed steeply, far surpassing their European peers. This jump in Swiss imports was not broad-based, but focused on a single commodity: gold.

Nonmonetary gold imports into the United States skyrocketed between Q3 2024 and Q1 2025, showing a year-over-year increase of over 1,600 percent. This specific increase in gold purchases indicates a clear pattern of precautionary buying. As economic and trade uncertainties rise, gold—long viewed as a safe-haven asset—becomes a preferred choice for businesses and investors seeking security. This behavior may also be part of broader portfolio diversification strategies during volatile periods.

The data illustrates that responses to trade policy uncertainty are not uniform. The surge in U.S. imports during the recent period of heightened uncertainty is not a generalized trend but rather a targeted movement, heavily driven by increased imports of gold from Switzerland. Other regions and commodities did not exhibit similar patterns, highlighting how strategic and selective such import behavior can be when businesses prepare for uncertain economic conditions.

Disclaimer:

The content presented in this article is based on publicly available data sourced from the Federal Reserve Economic Data (FRED) platform, which compiles statistics from institutions such as the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. While every effort has been made to ensure the accuracy, reliability, and timeliness of the data interpretation, this article is intended strictly for informational and educational purposes.

It does not constitute financial, investment, economic, or legal advice of any kind. Readers are advised not to make investment or business decisions based solely on the contents of this article.

The analysis provided reflects current and historical trends and should not be viewed as a forecast or guarantee of future economic performance. Economic conditions, policy decisions, and global events can rapidly change and impact market behaviors in unpredictable ways. Furthermore, this article is not affiliated with, endorsed by, or in any way officially connected to the Federal Reserve, the U.S. government, or any of the agencies referenced.