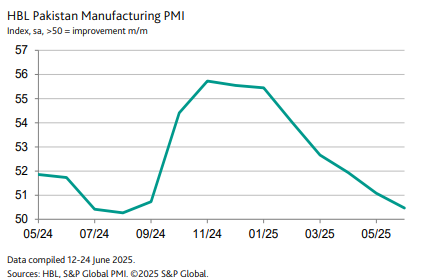

Pakistan Manufacturing PMI at 50.5 in June:Pakistan’s manufacturing sector continued its growth streak for the 14th consecutive month in June 2025, with the HBL Manufacturing PMI posting 50.5. However, output growth slowed to a 10-month low due to a sustained fall in new orders, mainly from the domestic market. Employment levels were cut for the third time in four months, and input cost inflation led to the sharpest increase in output prices since August 2024. While export orders showed signs of recovery, overall sentiment remained subdued due to rising taxes and geopolitical tensions.

Pakistan Manufacturing PMI at 50.5 in June: Output Growth Hits 10-Month Low, Demand Falls, Prices Surge

Pakistan’s manufacturing sector continued to expand in June, marking the fourteenth consecutive month of growth since the PMI survey began. However, the pace of expansion weakened for the second straight month, reflecting subdued domestic demand and mounting cost pressures.

According to the latest data released by S&P Global, the seasonally adjusted HBL Pakistan Manufacturing Purchasing Managers’ Index (PMI) posted a reading of 50.5 in June, marginally above the neutral 50.0 mark. This indicates a slight improvement in the overall health of the manufacturing sector, but it was also the weakest uptick since August 2024.

The slowdown was primarily driven by a sustained reduction in new order volumes. June marked the first instance of back-to-back declines in total new orders, although the pace of contraction was minimal. Manufacturers attributed the weakening demand to several challenges, including elevated electricity prices, increased taxation, and geopolitical tensions, particularly the ongoing conflict between Pakistan and India.

Despite the weakness in domestic demand, there was a silver lining in export performance. New export orders rose for the first time in three months, suggesting a recovery in international markets. Many manufacturers credited this rebound to improvements in the quality of Pakistani manufactured goods. This export recovery follows a period when, according to central bank data, exports had fallen to a ten-month low.

Production levels continued to rise in June but only marginally—the slowest growth rate in ten months. This subdued output growth was linked to firms relying more on existing inventories to fulfill orders. Consequently, stocks of finished goods fell for the second consecutive month. Manufacturers also reported a further solid reduction in backlogs of work, although the rate of depletion was the softest seen in 2025 so far.

The weakening demand prompted firms to adjust their operations accordingly. Staffing levels were reduced for the third time in the past four months, with companies citing both softer production needs and the need to contain rising costs.

Input purchases were also lowered slightly for the second consecutive month, while stocks of input materials remained broadly unchanged. Companies indicated that they maintained inventory levels to hedge against frequent price volatility and delivery disruptions, which were often caused by fuel and raw material shortages.

One of the more concerning trends in June was the resurgence in input price inflation. Costs rose sharply due to increased raw material prices and higher tax burdens. As a result, output prices also surged, with selling price inflation hitting its highest level since August 2024. Many firms passed on the cost burden to customers in a bid to protect profit margins.

Despite the current challenges, Pakistani manufacturers expressed cautious optimism about the future. Many firms pinned hopes on new product launches, business expansions, and potential easing in price pressures. However, the overall degree of optimism dipped to its lowest point in the 14-month survey history, reflecting unease about persistent inflation and geopolitical instability.

Commenting on the June data, Humaira Qamar of HBL said, “The HBL Manufacturing PMI came in at 50.5, above the 50-no change mark for the fourteenth consecutive month. However, the rate of growth slowed to a ten-month low amid a reduction in new order volumes. This was the first instance of consecutive demand contractions. To align with softer production needs, firms proactively reduced both staffing levels and input procurement.”

She added, “Encouragingly, there are signs of recovery in Pakistan’s exports which, as per central bank data, had hit a ten-month low last month. The New Export Orders Index rose for the first time in three months, with manufacturers attributing the uplift to improved quality standards. Reflecting muted demand, Pakistani manufacturers were able to remain on top of outstanding business in June, marking the sixth consecutive monthly decline in backlogs.”

Looking ahead, the industry remains hopeful about output expansion over the next 12 months, supported by a still-positive Future Output Index. Nonetheless, concerns surrounding higher taxation and regional tensions continue to weigh on sentiment.

HBL also noted that the current PMI trends may imply a GDP growth rate lower than the provisionally estimated 2.7% for fiscal year 2025, hinting at possible downward revisions in the near term.

Disclaimer:

This article is based on the latest PMI report data and comments provided by S&P Global and HBL. Market conditions are subject to change based on economic and geopolitical developments.