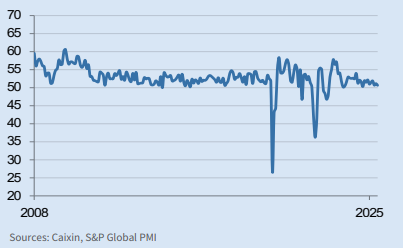

Softest Rise in China Services Activity in Nine Months:China’s services sector saw its weakest expansion in nine months in June 2025, as indicated by the Caixin Services PMI reading of 50.6. While the sector remained in growth territory for the 30th straight month, business activity, new orders, and export demand all showed signs of slowing. Employment declined slightly, leading to a sharp rise in backlogged work, while companies continued cutting output prices amid competitive pressures. Despite positive sentiment about future business conditions, overall confidence stayed below historical norms.

Softest Rise in China Services Activity in Nine Months, Falls to 50.6 In June

China’s service sector continued to expand at the end of the second quarter of 2025, but the pace of growth notably weakened, marking the slowest increase in nine months. According to the Caixin China General Services Business Activity Index, the reading dropped to 50.6 in June from 51.1 in May. Although this marked the 30th consecutive month of expansion (above the critical 50.0 threshold), the momentum showed signs of fatigue.

The slowdown in growth was largely driven by easing business activity and a deceleration in new order inflows. Despite ongoing marketing efforts and the introduction of new products, subdued global conditions weighed heavily on export demand. New export business declined for a second consecutive month, falling at the fastest pace since December 2022.

Employment within the services sector contracted marginally in June, the third time in four months. Many survey respondents linked the reduction in staffing levels to slower new order growth and heightened cost concerns. This job shedding contributed to a rise in backlogged work, which accumulated at the sharpest pace in a year.

Price dynamics also highlighted challenges. Input costs continued to rise, albeit marginally and at the slowest pace in three months. Raw material and fuel costs were the main inflationary drivers, while labor costs and interest payments declined slightly. Despite this, intense market competition and pressure to maintain competitiveness pushed service providers to cut their output charges for a fifth straight month. The pace of decline in output prices was the sharpest since April 2022.

The overall sentiment in the services sector remained positive, with companies expressing hope for economic recovery and future business expansion. However, the level of confidence remained below the historical average, suggesting cautious optimism. Service providers were hopeful that better domestic conditions and planned business activities could boost sales and service demand over the next 12 months.

Dr. Wang Zhe, Senior Economist at Caixin Insight Group, commented on the data, saying that while supply and demand continued to expand in June, growth in demand was limited despite efforts to secure new clients. He noted that external uncertainties had a greater negative effect on service exports and hiring activity. He emphasized that the trend of rising input costs alongside falling output prices persisted, which continued to compress profitability. Dr. Wang also stated that although optimism was sustained, sentiment remained weaker than the long-term average.

Meanwhile, the Caixin China General Composite PMI—which combines manufacturing and services indices—rose to 51.3 in June, up from 49.6 in May. This return to expansion in overall output was driven by a rebound in manufacturing activity, which compensated for the softer services performance. New business across the economy also showed improvement, though exports remained subdued.

Job shedding remained persistent across both sectors, with workforce capacity constrained. This led to the fastest accumulation of backlogs of work in a year. Average input costs showed a fractional decline after two months of inflation, and companies responded by cutting selling prices at the quickest pace in over two years in a bid to stimulate sales.

Dr. Wang Zhe added further perspective on the composite data, noting that while both supply and demand had returned to expansionary territory, the economy continues to face structural pressures. He pointed out that despite the stable operation of the economy and gradual market recovery, domestic demand remains insufficient and external conditions increasingly uncertain. He noted that recent macroeconomic indicators have diverged—while consumption in certain sectors has exceeded expectations, investment and industrial output have lost momentum.

He concluded that while short-term consumption has been supported by earlier stimulus policies, long-term recovery still depends on stabilizing employment, boosting confidence, and raising incomes.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Readers should do their own research or consult a professional before making any economic decisions.