JPMorgan Chase reported a strong Q2 2025 with $15 billion net income despite a 10% revenue decline. Solid growth in investment banking, markets, asset management, and card services fueled performance, while the bank maintained a robust 15% CET1 ratio and returned $11 billion to shareholders.

JPMorgan Chase Q2 2025 Results

JPMorgan Chase & Co., the largest U.S. bank by assets, reported strong second-quarter results for 2025, posting a net income of $15.0 billion, or $5.24 per share. Excluding a one-time tax benefit, net income was $14.2 billion or $4.96 per share. Despite a year-over-year dip in total revenue, the bank demonstrated resilience across key business segments, supported by robust markets revenue and growth in investment banking and asset management.

Total managed revenue for the quarter stood at $45.7 billion, down 10% year-on-year. Net interest income rose 2% to $23.3 billion, while noninterest revenue declined 20% to $22.4 billion. The decrease in noninterest revenue was primarily due to the absence of a $7.9 billion Visa-related gain booked in the same period last year. Excluding that item and securities losses, noninterest revenue was up 8%, driven by asset management fees, investment banking gains, and card-related income.

Noninterest expense Of JPMorgan was flat year-over-year at $23.8 billion. Excluding last year’s $1.0 billion Visa Foundation contribution, expenses rose 5%, attributed to higher compensation, technology spending, and operating costs.

Credit costs of JPMorgan came in at $2.8 billion, including $2.4 billion in net charge-offs—primarily in card services—and a $439 million net reserve build, reflecting conservative provisioning amid evolving macroeconomic risks.

JPMorgan’s return on equity (ROE) was 18%, while return on tangible common equity (ROTCE) stood at 21%. The bank maintained a solid capital position with a CET1 capital ratio of 15%, well above regulatory minimums, and held $1.5 trillion in cash and marketable securities.

Chairman and CEO Jamie Dimon commented, “We reported another quarter of strong results, generating net income of $15.0 billion. Each of our businesses performed well, with standout performance in markets, card services, and asset management.” He also highlighted the bank’s continued commitment to clients, noting strong new card acquisitions and a refreshed Sapphire Reserve product launch.

Looking at business segments:

Consumer & Community Banking (CCB):

Net income rose 23% to $5.2 billion, on a 6% increase in revenue to $18.8 billion. Growth was led by card services and auto lending, which saw a 15% revenue rise, supported by higher revolving balances and lease income. Banking and wealth management revenue rose 3% on stronger asset management fees. Despite flat reserves, net charge-offs in card services were $2.1 billion.

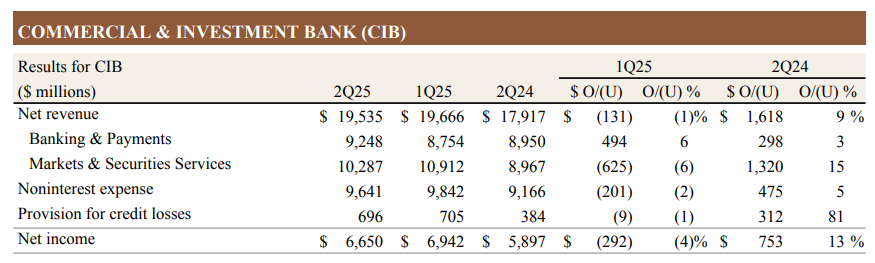

Commercial & Investment Bank (CIB):

Net income was up 13% year-over-year to $6.7 billion. Total revenue climbed 9% to $19.5 billion. Markets revenue hit $8.9 billion, up 15%, with fixed income and equity markets both growing 14-15%. Investment banking fees rose 7% driven by stronger debt underwriting and advisory activity. The segment also saw a reserve build of $371 million and $325 million in charge-offs.

Asset & Wealth Management (AWM):

AWM posted $1.5 billion in net income, a 17% increase. Revenue grew 10% to $5.8 billion, reflecting strong growth in assets under management (AUM), which reached $4.3 trillion—up 18% from the prior year. Client assets totaled $6.4 trillion, supported by $80 billion in net inflows and higher market valuations.

Corporate Segment:

Net income in the corporate segment was $1.7 billion, primarily due to a $774 million income tax benefit related to the resolution of audits and tax regulation changes. However, revenue dropped to $1.5 billion from $10.1 billion last year, due to the absence of the prior year’s Visa gain. Noninterest expense also fell significantly due to last year’s $1.0 billion philanthropic expense.

JPMorgan returned $11 billion to shareholders in the quarter, including $3.9 billion in common dividends and $7.1 billion in share buybacks. The board intends to increase the dividend again, marking a 20% cumulative increase since Q4 2024.

Dimon noted the strength of the U.S. economy but remained cautious. “Tax reform and potential deregulation are positives, but risks from trade tensions, geopolitical instability, fiscal deficits, and asset bubbles persist. We hope for the best but prepare for a wide range of scenarios.”

JPMorgan continues to serve a broad global client base and raised $1.7 trillion in credit and capital year-to-date, including $135 billion for consumers and $1.5 trillion for corporations and non-U.S. entities.

The firm will host its Q2 earnings call on July 15, 2025, at 8:30 a.m. ET. Full financial details and webcast access are available on its investor relations website.

Disclaimer:

This article is based on JPMorgan Chase & Co.’s official Q2 2025 earnings release and financial supplements. All financial figures are as reported by the company. This is not investment advice. Please consult a financial advisor before making investment decisions.