Wells Fargo delivered a strong financial performance in the second quarter of 2025, posting a net income of $5.5 billion and earnings per share (EPS) of $1.60, marking a 12% year-over-year increase. Total revenue reached $20.82 billion, driven by growth in both net interest and noninterest income. The results reflect the positive impact of the bank’s operational efficiency, strong credit quality, and the removal of its long-standing asset cap—a major regulatory milestone.

Segment-wise, Consumer Banking and Lending showed stable growth, while Corporate and Investment Banking benefited from higher advisory fees and fixed income gains. Wealth and Investment Management posted record client assets of $2.35 trillion. The company also returned over $6 billion to shareholders in the first half of the year and announced a planned dividend increase for Q3 2025. With improving credit trends and higher profitability, Wells Fargo continues its transformation into a more resilient and growth-focused financial institution.

Wells Fargo Q2 2025 Earnings

Wells Fargo & Co. reported strong second-quarter 2025 financial results, with net income rising to $5.5 billion, or $1.60 per diluted share—up from $4.9 billion, or $1.33 per share, in the same period last year. This robust performance reflects solid credit quality, increasing fee-based income, and continued operational discipline amid a challenging macroeconomic environment.

Top-Line Highlights

Total revenue of Wells Fargo in Q2 2025 stood at $20.82 billion, up 1% year-over-year and 3% sequentially. Net interest income fell slightly by 2% to $11.7 billion, mainly due to lower rates affecting floating-rate assets, but was still up 2% from the previous quarter. Noninterest income rose 4% year-over-year to $9.11 billion, supported by higher investment banking fees, asset-based fees, and a $253 million gain from acquiring the remaining interest in its merchant services joint venture.

Provision for credit losses dropped to $1.01 billion from $1.24 billion a year ago. Net charge-offs were $997 million, down significantly from $1.3 billion a year earlier, reflecting stronger credit performance. Noninterest expenses rose slightly by 1% to $13.38 billion.

Return on equity (ROE) improved to 12.8%, compared to 11.5% a year ago. Return on tangible common equity (ROTCE) climbed to 15.2% from 13.7%.

CEO Remarks and Strategic Milestones

CEO Charlie Scharf stated of Wells Fargo , “Our second quarter results reflect the progress we are making to consistently produce stronger financial results.” He added that the company’s asset cap removal was a major milestone, unlocking growth potential that had been restrained since 2018.

Wells Fargo has also terminated 13 consent orders since 2019, including seven in 2025 alone. “We are a far stronger company today because of the work we’ve done,” Scharf said.

Capital Returns and Shareholder Value

The bank repurchased 43.9 million shares worth $3.0 billion during the quarter. It has returned over $6 billion to shareholders in the first half of 2025 and expects to increase its Q3 dividend by 12.5% to $0.45 per share, pending board approval.

The CET1 ratio stood at 11.1%, while the liquidity coverage ratio (LCR) was 121%. The Federal Reserve recently reduced Wells Fargo’s Stress Capital Buffer (SCB) from 3.8% to 3.7%, with a proposed rule possibly adjusting it to 2.6%.

Segment Performance

Consumer Banking and Lending posted a 2% revenue increase to $9.23 billion, with net income at $1.86 billion, up 5% year-over-year. Credit card revenue surged 9% on higher balances, while auto and personal lending declined. Loans averaged $315.4 billion, down 3% year-over-year, while deposits held steady at $781.4 billion.

Commercial Banking reported a 6% decline in revenue to $2.93 billion, driven by a 13% drop in net interest income due to rate pressure. However, noninterest income rose 13% thanks to tax credit investments and stronger treasury management. Net income was $1.09 billion, down 8% year-over-year. Loans averaged $226.5 billion, while deposits grew 7% to $178 billion.

Corporate and Investment Banking delivered revenue of $4.67 billion, down 3% from last year. The markets segment saw strong performance in fixed income, currencies, and commodities, while equities were down sharply. Net income was $1.74 billion. Notably, the investment banking unit grew revenue by 8%. Average loans rose 4% year-over-year to $285.9 billion.

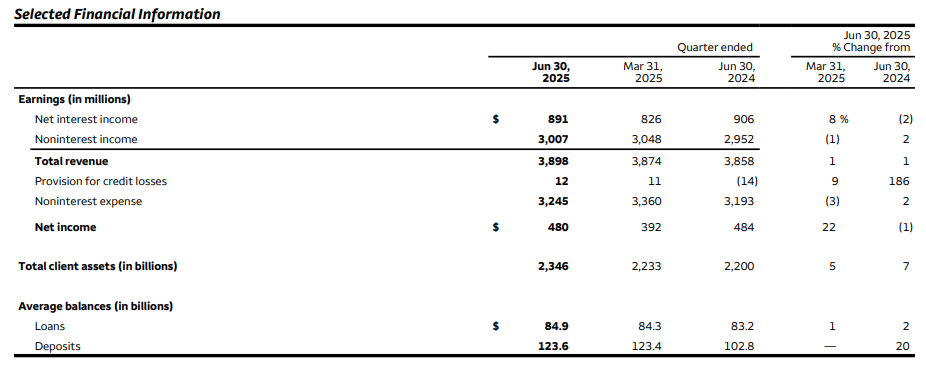

Wealth and Investment Management revenue rose 1% to $3.9 billion, supported by a 2% increase in asset-based fees amid strong market valuations. Net income was $480 million, and client assets totaled $2.35 trillion, up 7% from last year. Average deposits grew 20% to $123.6 billion.

Corporate reported a $328 million profit, a sharp turnaround from a $318 million loss a year ago. The performance was lifted by the merchant services joint venture gain and reduced FDIC assessment expenses.

Credit Metrics Remain Solid

Nonperforming assets fell 3% sequentially to $7.96 billion, or 0.86% of total loans. Nonaccrual loans declined to $7.76 billion. Net charge-offs as a percentage of total loans improved to 0.44% from 0.57% last year.

The allowance for credit losses stood at $14.57 billion, or 1.58% of total loans.

Outlook and Forward Strategy

Wells Fargo remains cautious but optimistic about the U.S. economic outlook, citing strong consumer and commercial credit trends. CEO Scharf emphasized that the bank will continue investing in business growth while maintaining tight expense controls and returning capital to shareholders.

Disclaimer:

The information provided in this article is based on the official Q2 2025 earnings release published by Wells Fargo & Company. All financial data, forecasts, and commentary are subject to change and should not be construed as investment advice. Readers are encouraged to consult official filings and financial professionals before making any financial decisions. The views and interpretations presented here are for informational purposes only and do not represent any recommendation or endorsement.