US Inflation continues to ease, but the Federal Reserve holds off on rate cuts. Former Fed Governor Randy Kroszner explains why services inflation, tariffs, and cautious Fed policy are shaping the interest rate outlook for 2025.

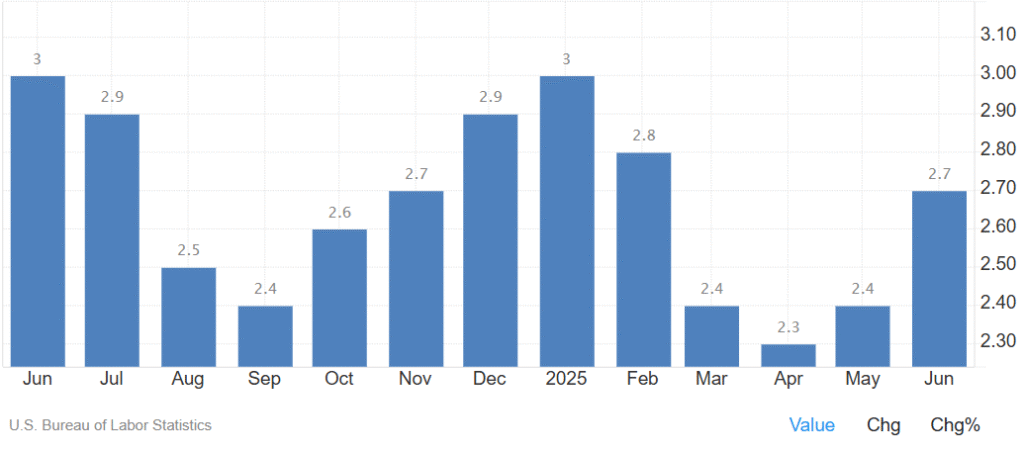

US Inflation Falls for Fifth Straight Month to 2.7%

In a conversation with Media that brought clarity to the complex economic environment of mid-2025, former Federal Reserve Governor Randy Kroszner offered valuable insights into US inflation trends, interest rate decisions, and the political undercurrents shaping monetary policy. With US inflation cooling for the fifth consecutive month and markets beginning to anticipate a shift in interest rate policy, Kroszner provided context and caution.

One of the key themes dominating the discussion was US inflation, which has recently shown a downward trend. For five straight months, inflation has either been in line with or below expectations. This has reignited calls from various quarters for the Federal Reserve to start cutting rates. However, the Fed appears cautious, preferring to wait for more consistent signals before acting.

Kroszner pointed out that while there are some early signs of inflationary pressure in specific categories—such as toys and furniture—attributable possibly to recent tariffs, the broader impact remains subdued. “If you look overall, it’s hard to see a big impact yet,” he noted. The underlying question remains: Is this a preview of inflation returning, or just a one-off anomaly?

He further explained that much of the Consumer Price Index (CPI) US inflation is being driven by services, particularly housing and shelter-related services. These sectors are largely unaffected by tariffs and continue to remain stable. This stability in core services inflation is providing a cushion, preventing broader inflation from spiking despite the ongoing tariff debate.

The conversation then shifted to why the Fed is still holding off on cutting interest rates despite consistent signs of easing inflation. Kroszner acknowledged that there are some policymakers within the Fed who would argue in favor of an immediate rate cut, especially given the favorable inflation data. “You can keep waiting and waiting, but at some point, you have to make a decision,” he warned.

Still, the majority within the Fed seems to prefer a cautious approach. “Their preference would be to continue to pause,” he said, noting that the central bank is likely to start considering cuts around September 2025, rather than in July. If a decision is made to cut, Kroszner believes the Fed could consider trimming rates at every meeting for the remainder of the year—assuming the data supports such moves.

The broader debate around US inflation also includes the impact of import tariffs. With imports constituting roughly 13% of the U.S. GDP, and with many exceptions and temporary suspensions applied to the tariffs, Kroszner finds it difficult to see a sustained inflationary impact from trade policy alone. “It’s hard to see that it’s going to have this enormous impact,” he stated. Fortunately, short-term inflation expectations have started to decline, which suggests that fears of entrenched inflation may be overblown.

However, Kroszner was quick to caution against extreme policy responses. When asked about the idea of cutting rates by 300 basis points—a move floated in some circles—he firmly opposed it. “That seems a little far as far as I’m concerned,” he remarked, suggesting that such aggressive easing would be premature and potentially risky.

The discussion also touched on political interference in monetary policy, a topic that has been bubbling as public and political pressure on Federal Reserve Chair Jerome Powell intensifies. Some signs of pushback have emerged from the administration, particularly via the Office of Management and Budget (OMB) and former officials like Kevin Hassett. Kroszner emphasized the importance of Federal Reserve independence in such situations.

He acknowledged that criticism comes with the territory, especially in times of economic uncertainty. Recalling his own experience during the 2008 global financial crisis, Kroszner noted, “People weren’t saying the nicest things in the world about the Fed at the time.” The current political noise, while louder and more public, is not unprecedented.

Kroszner hopes that Powell and the current Fed board can maintain their focus on data-driven decisions. “They have to have elephant-thick skin,” he said. Markets, he added, are looking for a Fed that operates independently and prioritizes economic fundamentals over political rhetoric.

In summary, US inflation remains the defining issue of the moment. While it is currently trending downward, the Federal Reserve is not yet ready to ease interest rates. Kroszner’s perspective offers a balanced view: inflation is under control for now, but caution is necessary. The trajectory of tariffs, service costs, and political influence will continue to shape the Fed’s policy path over the coming months.

Disclaimer:

This article of US Inflation is for informational purposes only and should not be construed as financial advice. Please consult with a financial advisor before making investment or economic decisions.