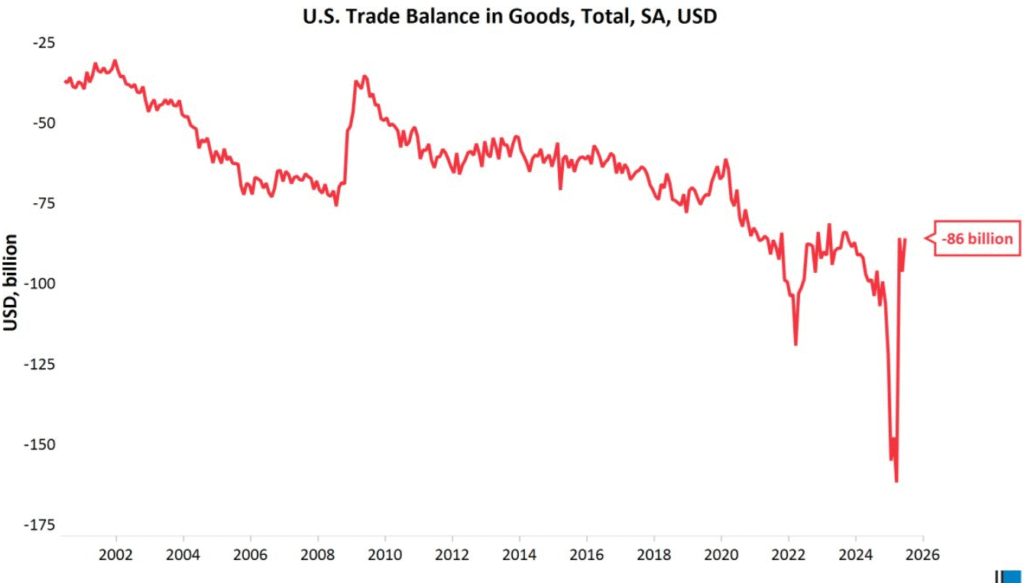

In June 2025, the U.S. goods trade deficit narrowed sharply by 10.8% to $86 billion—its lowest level since September 2023—driven by a steep drop in imports, especially consumer goods. While the improvement lifted Q2 GDP growth forecasts to 2.9%, it also signals weakening domestic demand, soft labor market conditions, and modest inventory growth, raising concerns about the strength of the U.S. economic rebound.

U.S. Goods Trade Deficit Narrows Sharply in June 2025 to $86 Billion

The U.S. trade deficit in goods shrank significantly in June 2025, dropping to $86 billion from $96.4 billion in May, according to the latest Advance Economic Indicators Report from the U.S. Census Bureau. This 10.8% reduction marks the narrowest goods trade deficit since September 2023 and comes as an unexpected shift driven largely by a steep drop in imports, particularly consumer goods.

The latest data revealed that total U.S. imports declined by 4.2% month-over-month in June. Consumer goods led the downturn with a dramatic plunge of over 12%, while imports of industrial supplies and food also fell. On the other hand, imports of capital goods showed a slight increase, suggesting selective strength in business-related demand. Year-over-year, imports have fallen by 2.5%, underlining a weakening trend in domestic demand.

Exports also declined slightly by 0.6% in June, weighed down by a notable fall in industrial supplies. However, the decline in exports was not uniform; other export categories posted gains that partly offset the overall dip. On an annual basis, exports were up 3.6% compared to June 2024, highlighting continued resilience in certain U.S. export sectors despite global trade uncertainties.

While the narrowing trade deficit is expected to provide a boost to gross domestic product (GDP) growth for the second quarter, economists warn that the underlying factors driving this improvement are not entirely positive. The drop in imports, particularly of consumer goods, is being viewed as a potential signal of softening domestic demand. The Atlanta Federal Reserve has revised its Q2 2025 GDP growth forecast to 2.9%, up from earlier estimates, largely attributing the improvement to trade after it had previously been a major drag on economic performance.

However, other economic indicators suggest caution. Inventory levels have risen only modestly. Advance wholesale inventories increased by just 0.2% in June to reach $907.7 billion, up from $906.0 billion in May. Retail inventories rose by 0.3% month-over-month, standing at $808.7 billion in June compared to $806.7 billion in May. These incremental changes, while positive, do not point to robust inventory restocking, which could limit the strength of any GDP rebound.

The labor market is also showing early signs of strain. Job openings and hiring have both declined, especially in the accommodation and healthcare sectors. Although employers are still hesitant to lay off workers, the momentum in new hiring is clearly slowing. The national unemployment rate, which stood at 4.1% in June, is now expected to tick slightly higher to 4.2% in July, reflecting this softer employment trend.

The broader context shows that while a narrower trade deficit lifts headline GDP figures, the reason behind the improvement—reduced imports—raises concerns. Falling imports often indicate reduced consumer and industrial demand, and if this trend continues, it could weigh on future economic activity. Additionally, flat export growth and soft inventory expansion further complicate the overall picture.

In conclusion, the U.S. goods trade deficit narrowed more than expected in June 2025, offering temporary support to GDP numbers. However, the steep decline in consumer goods imports, slowing labor market, and modest inventory growth all point to underlying fragility in the domestic economy. Policymakers and economists alike will be watching closely to determine whether this marks the beginning of a more sustainable recovery or signals deeper economic weakness ahead.

Disclaimer:

This article is for informational purposes only and is based on publicly available data from the U.S. Census Bureau and other official sources as of July 29, 2025. It does not constitute financial, investment, or economic advice. Readers are advised to consult with qualified professionals before making any financial or policy decisions based on this content.