US President Donald Trump has announced a potential 25% tariff on Indian imports, raising concerns over trade relations between India and the United States. In this blog, we break down why Trump is targeting India, how past negotiations have played out with other countries, and what this means for the Indian economy, stock market, and export-heavy companies. From electronics and auto parts to gems and jewellery, find out which sectors and companies could face the biggest impact if these tariffs are implemented. This is a data-backed, detailed analysis of the latest chapter in US-India trade tensions.

Trump’s 25% Tariff on India

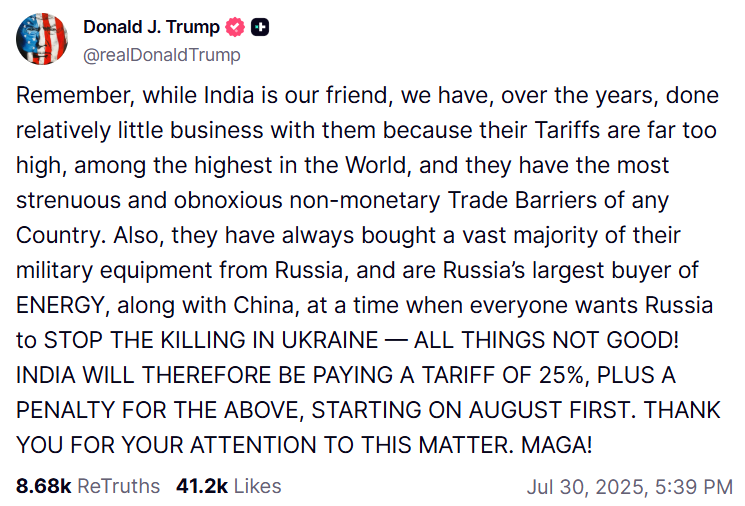

In a development that has rattled both diplomatic corridors and stock markets, U.S. President Donald Trump has announced a potential 25% tariff on Indian imports. This announcement, made on his social media platform Truth Social, has sparked a range of questions: Is this the end of India-U.S. economic cooperation as we know it? What could be the real impact on India’s economy, trade, stock markets, and specific listed companies? Will Trump backtrack like before? Or is this a well-calculated pressure tactic?

This article dives deep into the sequence of events, India’s response, Trump’s tariff playbook, the history of similar trade deals with other nations, and the likely implications on sectors and companies deeply exposed to the U.S. market.

A Friendship on the Edge?

Trump’s 25% Tariff on India: President Trump has long referred to India as a “friendly country.” Many still remember his grand reception at Ahmedabad’s Motera Stadium during his 2020 visit, where lakhs of Indians welcomed him. Fast forward five years, and Trump seems to have moved on. His latest move – threatening a 25% tariff on Indian goods – feels less like friendly competition and more like an economic cold shoulder.

Moreover, Trump went a step further, warning that if India continues to purchase oil and defense products from Russia, more penalties will follow. Naturally, this has sparked concerns across India’s political, economic, and investment circles.

Timeline of the Tariff Drama

Trump’s 25% Tariff on India:The Trump administration first floated the idea of these tariffs on April 2nd, dubbing the move as part of “Liberation Day” – a symbolic attempt to reshape global trade. However, within a week (by April 9th), the White House placed a 90-day hold on the tariffs. That grace period has now expired, and Trump seems ready to return to the battlefield.

Notably, India is not alone. Several countries have already negotiated or are struggling under similar tariff threats:

- UK, Japan, EU, Indonesia: Have finalized trade deals with the U.S.

- China: Initially hit with a massive 145% tariff, later reduced to 30% after intense negotiations.

- Brazil: Facing 50% tariffs.

- Canada: Hit with a 30% tariff.

- Indonesia: Agreed to a deal involving agricultural, energy, and aircraft imports from the U.S., in exchange for a 19% tariff rate.

India’s deal is still under negotiation. Experts believe that Trump’s standard negotiation strategy includes announcing steep tariffs, then gradually lowering them through bilateral talks. The final number, therefore, may end up between 15% and 18%, not 25%.

What Is Trump Upset About?

Trump’s 25% Tariff on India:One of Trump’s consistent complaints has been India’s high import duties. Here are the typical tariff rates India imposes:

- Dairy products: 30% to 60%

- Farm products: 30% to 50%

- Automobiles: 70% to 100%

- Wines: 100% to 150%

In 2024, India-U.S. bilateral trade reached $129 billion. Out of this, Indian exports to the U.S. were $87 billion, while U.S. exports to India were just $42 billion – a $45 billion trade deficit for the U.S. Trump views this imbalance as unfair, further fueling his motivation for imposing tariffs.

However, there’s another side to the story. The U.S. earns over $80 billion from India through the services sector, including education, finance, digital platforms, intellectual property, and royalties. These earnings are not considered part of the official trade balance by U.S. authorities, but they significantly tilt the actual economic exchange in America’s favor.

For instance, when an Indian buys Nike shoes or uses YouTube, royalty payments flow to the U.S. parent company. This hidden cash flow is one of the biggest gaps in how trade numbers are perceived between the two nations.

What Happens If 25% Tariff Stays?

Trump’s 25% Tariff on India:If the proposed tariffs remain in place, several Indian sectors and companies are likely to be directly impacted, particularly those with high export dependence on the U.S.

Top Affected Sectors & Companies:

- Electronics and Electrical Equipment (Exports: $12 billion)

- Dixon Technologies: Around 9% of revenue comes from exports, including supplying Google Pixel phones to the U.S.

- Auto and Forging Components

- Samvardhana Motherson International: ~65% revenue from exports; 20–25% from the U.S.

- Krishna Institute of Technology (KSTC): 20–30% of revenue from exports; U.S. contributes 5–10%.

- Sona BLW Precision Forgings: 40% revenue from the U.S.

- Ramkrishna Forgings: 27% revenue from the U.S.

- Bharat Forge: 35–38% U.S. revenue exposure.

- Tata Motors: 23% U.S. exposure, mainly via Jaguar Land Rover.

- Gems & Jewelry (Exports: $9.15 billion)

- Key companies: Rajesh Exports, Vaibhav Global, Titan, Kalyan Jewellers.

These companies could face long-term pressure if the tariffs persist. Any cost escalation due to tariffs could shrink margins, reduce competitiveness, and hurt stock valuations.

Will India Suffer Massively?

Trump’s 25% Tariff on India:Not really. While specific sectors will be hit, India’s overall economic resilience remains strong. India is largely a domestic-demand-driven economy. In sectors like solar energy, Indian companies can’t even meet local demand due to capacity constraints.

For example, solar companies like Adani Green and Waaree are facing demand-supply mismatches domestically, indicating that India has enough internal consumption to absorb much of its production.

Moreover, unlike Vietnam or Cambodia, whose economies are heavily export-dependent, India’s growth model is more diversified. Hence, any U.S. tariff impact would be sector-specific, not macroeconomic.

India’s Advantage in Negotiation

Trump’s 25% Tariff on India:In trade diplomacy, leverage often lies with the country that needs the deal less. India’s internal demand, growing infrastructure, and alternative trading partners give it a better hand. Experts believe India can hold its ground and reach a mutually agreeable tariff rate — likely below the original 25% mark.

While Trump’s threats have sparked headlines and created temporary panic, this may just be another move in his high-stakes trade poker. History suggests he often uses extreme positions as bargaining chips.

Trump’s 25% Tariff on India:The stock market may see temporary volatility, but long-term investors should focus on fundamentals. Companies with heavy U.S. exposure should be watched closely. For all other sectors, the Indian growth story remains intact.

Trump’s 25% Tariff on India:As this tariff saga unfolds, investors, policymakers, and businesses alike will be watching closely. One thing is clear — global trade equations are no longer driven just by economics, but by politics, power, and negotiation.