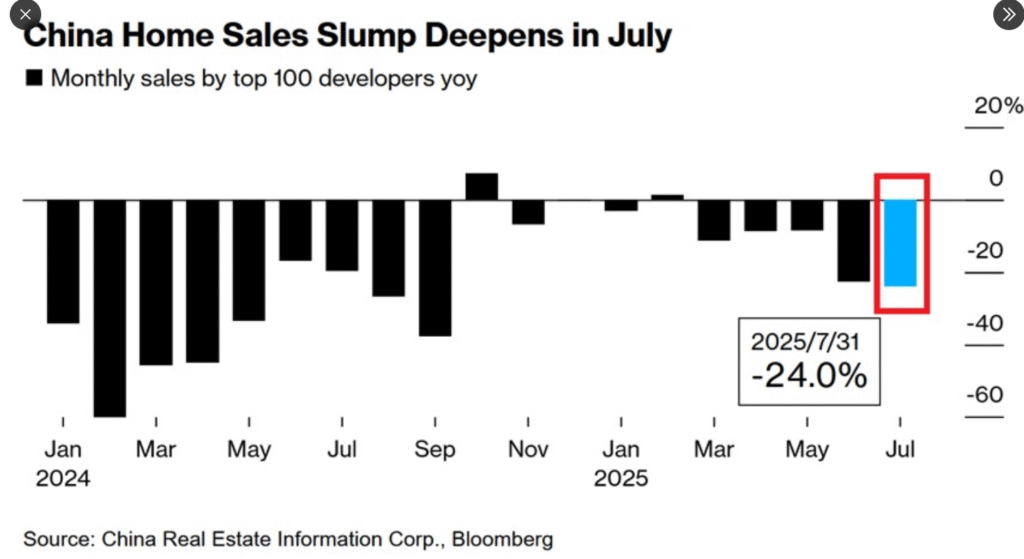

China housing crisis: China housing market is facing a deepening crisis as new-home sales by the top 100 developers plunged 24% year-over-year in July 2025—the sharpest decline in 10 months. Month-over-month sales crashed by 38%, the worst fall this year. With home prices also recording their steepest drop in 8 months and Goldman Sachs projecting long-term demand to remain 75% below 2017 peak levels, the outlook appears grim. Analysts warn this could be China’s version of the 2008 housing crash.

China Housing Crisis Deepens

China’s real estate sector, long seen as a vital pillar of its economic growth, is now in the midst of a historic and potentially destabilizing slump. According to the latest data released by China Real Estate Information Corp. and published by Bloomberg, new-home sales by the country’s top 100 developers fell by a staggering 24% year-over-year in July 2025. This marks the most significant annual decline in almost ten months and underscores deepening cracks in the world’s second-largest economy.

China Housing Crisis Deepens:Even more troubling is the month-over-month data. Compared to June, July’s home sales fell 38%, the sharpest monthly drop recorded in 2025 so far. This isn’t just a momentary dip—it’s part of a persistent and accelerating decline that has now entered its second consecutive year. The newly released bar chart clearly illustrates a worsening trend that began in early 2024, with July 2025’s blue bar standing out for its severity.

July’s sales figures come on the heels of another worrying signal. In June, the Chinese housing market recorded its biggest monthly decline in new-home prices in the past eight months. Price weakness, when combined with sales slumps, paints a picture of a market rapidly losing both investor and consumer confidence.

China Housing Crisis Deepens:For many analysts, this isn’t just a normal downturn. The housing sector, which once contributed close to 30% of China’s GDP when considering its vast linkages with construction, steel, cement, and consumer spending, is now at risk of triggering broader financial and social consequences. Some observers are going so far as to compare this collapse to the 2008 housing crash in the United States—an event that brought the global economy to its knees. The phrase “China’s 2008 is happening now” is no longer seen as hyperbole in financial circles.

One of the most concerning aspects of this downturn is that it appears to be structural rather than merely cyclical. According to an in-depth analysis by Goldman Sachs, demand for new homes in Chinese cities is expected to stay roughly 75% below its 2017 peak levels for several years. That forecast challenges any near-term hopes for a V-shaped recovery and raises serious questions about the long-term future of real estate as an engine of China’s growth model.

China Housing Crisis Deepens:The decline in demand is fueled by several factors. A key one is demographic. China’s population is aging rapidly, and the younger generation is more hesitant to invest in property—especially in a market where prices are falling and developers are increasingly failing to deliver completed projects. Moreover, a significant number of homes in China remain vacant. Estimates suggest there could be enough empty properties to house hundreds of millions of people. This glut is undermining the basic supply-demand balance and pushing prices and activity downward.

China Housing Crisis Deepens:On top of that, regulatory and credit risks continue to weigh heavily on the market. Beijing’s crackdown on excessive borrowing by property developers in recent years, under the “three red lines” policy, has significantly tightened liquidity. While the government has since eased some restrictions in an effort to stabilize the sector, confidence has yet to return. Many developers—once considered untouchable giants—are now facing insolvency or are struggling to meet construction deadlines, further shaking the faith of both homebuyers and investors.

The effects of this crisis are already spilling over into other sectors. Construction activity has slowed dramatically, affecting steel and cement production, labor markets, and local government finances, which have historically depended on land sales for revenue. Financial institutions, too, are under stress, as exposure to the real estate sector through loans, bonds, and wealth management products remains high.

China Housing Crisis Deepens:China’s policymakers find themselves in a difficult position. Stimulus measures, such as reducing mortgage rates and offering subsidies, have had limited effect so far. Consumer sentiment remains weak, and people are more focused on safeguarding existing wealth than investing in depreciating assets. Moreover, the broader economy is showing signs of fatigue, with manufacturing activity slowing and youth unemployment reaching record levels.

China Housing Crisis Deepens:International markets are also watching this situation with growing concern. China’s slowdown has global implications—from reduced demand for commodities like iron ore and copper to weakened economic activity in emerging markets that depend on Chinese investment and trade. Multinational firms with significant exposure to the Chinese consumer and housing market are beginning to revise their growth expectations downward.

China Housing Crisis Deepens:For now, July’s 24% annual drop in home sales and the 38% plunge from the previous month serve as the latest warnings in what is becoming an increasingly alarming story. Despite efforts from Beijing to support the sector and shore up sentiment, it is evident that the housing market is stuck in a prolonged correction.

China Housing Crisis Deepens:What makes this situation even more fragile is the underlying shift in consumer psychology. During the boom years, property was seen as the safest and most profitable investment by Chinese households. That perception is now eroding rapidly. As home prices fall, more and more citizens are questioning the value of owning property—especially when alternatives like fixed income or overseas investments appear safer.

The housing market is often said to reflect the health of an economy. In China’s case, it may now reflect a turning point. The real estate sector’s crisis is not just about declining numbers—it’s about a deeper loss of confidence in an economic model that relied too heavily on building, borrowing, and speculating.China Housing Crisis