The UK car market in July 2025 saw a 5% year-on-year decline in total new car registrations, with 140,154 units sold. While petrol, diesel, and hybrid sales dropped, battery electric and plug-in hybrid vehicles showed strong growth. New Chinese brands like BYD, Jaecoo, and Omoda made a notable impact, even as legacy automakers like BMW, Nissan, and Tesla saw significant declines. This detailed report covers full brand-wise sales data, fuel-type market shares, and key shifts in the UK’s evolving auto landscape.

UK July 2025 Car Market Report

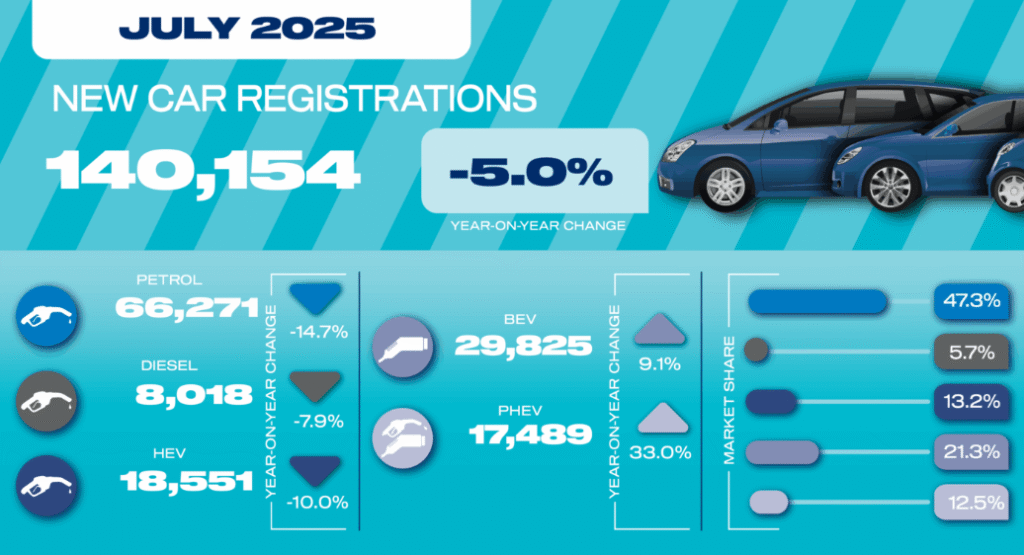

The UK automobile market in July 2025 recorded 140,154 new car registrations, marking a year-on-year decline of 5.0% compared to July 2024’s total of 147,517 units. While some legacy brands lost momentum, the EV segment gained pace, and new Chinese entrants made notable inroads into the market.

A closer look at fuel-type trends reveals a clear shift in consumer preferences. Petrol-powered vehicles, which still account for the largest share, recorded 66,271 registrations but fell by 14.7% compared to last year. Diesel cars also continued their downward trend, declining by 7.9% to 8,018 units. Hybrid electric vehicles (HEVs) saw a 10.0% drop with 18,551 units sold.

In contrast, battery electric vehicles (BEVs) saw a positive year-on-year growth of 9.1%, with 29,825 units sold, while plug-in hybrid vehicles (PHEVs) jumped by a substantial 33.0%, reaching 17,489 registrations. As a result, BEVs now hold a market share of 21.3%, PHEVs 12.5%, HEVs 13.2%, diesel 5.7%, and petrol remains the largest at 47.3%.

Brand-wise, the picture remains mixed. Volkswagen remained the top-selling brand in July 2025 with 13,452 units, despite a 4.23% decline from the previous year. Ford followed closely with 9,106 units sold, up 16.53% from last year. Kia, Audi, and BMW rounded out the top five, but all posted year-on-year declines of 7.54%, 7.32%, and 18.17% respectively.

Chinese brands emerged as key players. BYD surged 314.58% to 3,184 units, while new entrants like Jaecoo and Omoda, which had no presence last year, sold 1,915 and 1,874 units respectively. Leapmotor entered the scene with 248 units, and Xpeng recorded 8.

On the luxury front, Bentley sales rose 68.00%, while Mini saw a 46.59% increase. Conversely, Jaguar reported zero sales compared to 1,058 in July 2024. Mercedes-Benz, Land Rover, and Volvo all declined, by 15.53%, 14.93%, and 33.41% respectively. Tesla’s performance was notably poor, dropping 59.91% with just 987 units sold this July.

Several other brands saw sharp shifts. Alpine grew by an astonishing 395.45% (from 22 to 109 units), while Cupra rose 30.06% and Peugeot increased sales by 33.37%. Skoda also had a strong month, with a 30.21% rise to 6,772 units. In contrast, SEAT saw a dramatic fall of 54.01%, and Citroen declined by 41.29%.

Among Japanese brands, Nissan dropped 22.74%, Toyota fell by 22.68%, and Suzuki slipped by 43.58%. Honda registered a 46.17% fall, selling only 1,314 units. Mazda defied the trend with a 9.05% increase to 1,915 vehicles.

The electric-only brands presented a mixed bag. MG declined 9.53% to 5,637 units, while Polestar remained flat with a marginal 0.49% increase. Smart dropped by 12.5%, and Chevrolet re-entered the UK market with 11 units sold after being absent last year.

In the niche and luxury market, Genesis increased by 17.20% to 109 units, Maserati rose slightly by 3.23%, and Porsche grew 10.38% to 1,319 units.

Brands that completely vanished or reported no activity this July included Jaguar, Maxus, and Fisker. Others like Other British and Other Imports declined 47.77% and 35.26%, respectively, reflecting weakening interest in lesser-known nameplates.

The overall trends in July 2025 clearly indicate a turning point. Electric and plug-in hybrid vehicles are gaining traction, aided by emerging brands and technological advancement. Traditional combustion engine vehicles, particularly petrol and diesel, are steadily losing share, although they still dominate the market numerically. Established automakers face growing competition from agile Chinese players, while EV-only manufacturers like Tesla face new challenges in sustaining growth.

As the UK continues its transition towards cleaner mobility and consumers grow more receptive to alternative powertrains, the automotive landscape is expected to evolve rapidly in the coming months.