S&P 500 Earnings Gap Widens:A dramatic shift is unfolding within the S&P 500 as the top 10 companies — including tech giants like Apple, Meta, Microsoft, and Google — have grown their net income by 180% since 2019, far outpacing the 45% growth seen by the remaining 493 firms. This blog delves into the accelerating earnings divergence, the role of Big Tech in driving market performance, the latest Q2 2025 earnings results, and why over half of S&P 500 companies are now facing margin pressure while tech titans continue to beat expectations.

S&P 500 Earnings Gap Widens

The S&P 500 is no longer moving as one cohesive unit — it’s increasingly becoming a story of two markets: the top 10 companies and everyone else.

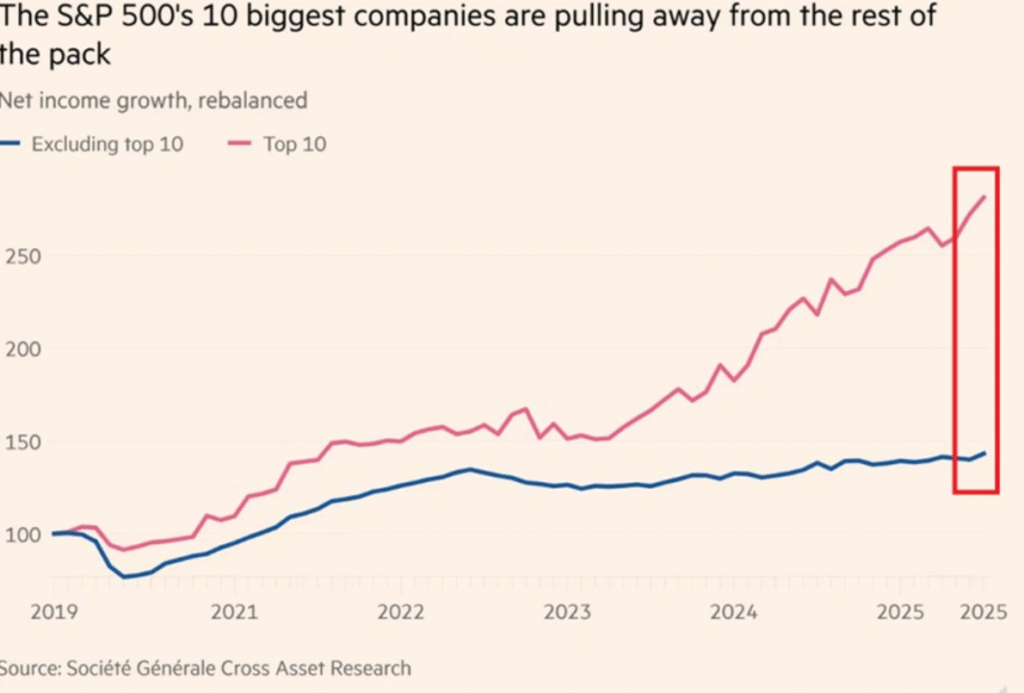

A striking chart from Société Générale Cross Asset Research highlights how the net income of the 10 largest companies in the S&P 500 has dramatically outpaced the rest of the index. Since 2019, these top 10 companies have seen their net income grow by an astonishing 180%.

Meanwhile, the other 493 companies in the index have recorded a mere 45% increase in net income during the same period — that’s roughly four times less. The divergence is growing sharper by the year.

The acceleration in this gap is especially noticeable from 2023 onward. The earnings of the top 10 firms began to surge at a much faster rate starting that year, and have nearly doubled since then. The chart makes it clear: a steep upward slope has formed for the top 10, while the line representing the rest of the index has flattened significantly.

This divergence has only grown more prominent during the latest earnings season in 2025. Of the roughly 70% of S&P 500 companies that have reported Q2 results so far, 52% have shown declining profit margins. It suggests a broad-based struggle among most companies to maintain profitability in a high-cost and competitive environment.

In stark contrast, the top tech giants are not only holding their ground but exceeding expectations. Major players like Apple ($AAPL), Meta ($META), Microsoft ($MSFT), and Alphabet/Google ($GOOGL) all beat Wall Street’s earnings forecasts for Q2 2025. Their strong results have reinforced investor confidence in mega-cap tech and pushed their net income even higher.

The trend indicates that big tech is getting even bigger. These firms are benefiting from scale, strong cash flows, monopolistic or dominant business models, and continued demand for their AI, cloud, and digital services. Their profit margins remain resilient even as the broader index struggles.

The chart clearly shows the divergence between the pink line (top 10 companies) and the blue line (rest of the S&P 500). The pink line has soared past the 250 mark on the net income growth index, while the blue line hovers just slightly above 140.

The red box on the chart emphasizes the most recent surge — a rapid spike in earnings growth for the top 10 companies in 2025, further pulling away from the rest of the market.

This trend raises important questions for investors:

- Is the S&P 500 still diversified if it’s increasingly driven by just 10 firms?

- What happens if even one of the top 10 falters?

- Are traditional valuation metrics still valid when earnings are so heavily concentrated?

As of now, the performance of the S&P 500 — and perhaps even the broader US market — is being carried by the earnings strength of a handful of tech titans. The divide is real, growing, and reshaping the market narrative in 2025.

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be construed as financial or investment advice. The views expressed are based on publicly available data and current market trends, which are subject to change. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not liable for any losses or damages arising from the use of this information