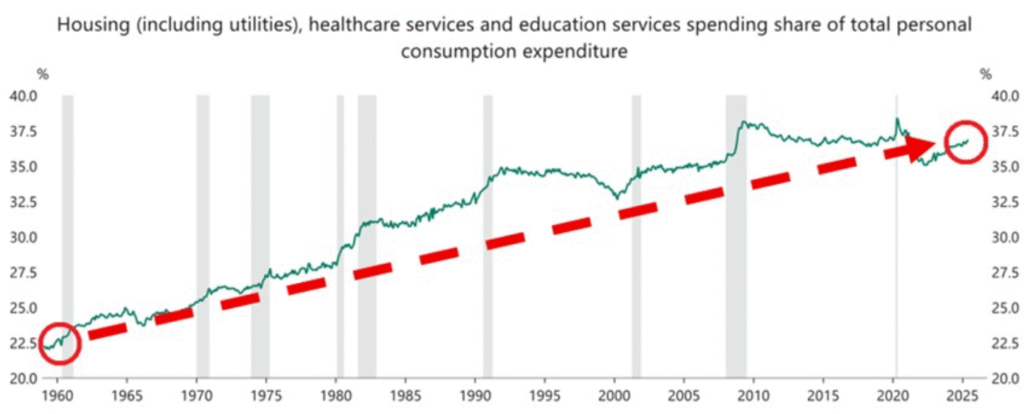

In 1960, U.S. households spent just 22% of their budgets on housing, healthcare, and college tuition. By 2025, that share has surged to nearly 37%, squeezing discretionary income and reshaping the middle-class lifestyle. This article explores the historical rise, economic drivers, and policy failures behind the soaring costs of essentials, with data showing hospital services up 271%, tuition up 194%, and housing up 108% since 2000—far outpacing overall inflation. The analysis also highlights broader social and political consequences, from widening inequality to rising frustration among younger generations.

How Housing, Healthcare, and Tuition Are Consuming 37% of U.S. Household

In 1960, American households spent around 22% of their total personal consumption expenditure on three essential categories: housing, healthcare, and college tuition. Fast forward to 2025, and that number has climbed to nearly 37%, just two percentage points shy of its historical peak. This massive shift highlights a long-term transformation in how Americans allocate their spending, and it’s sparking concern across economic, political, and social lines.

The steady climb from 22% to 37% over the last 65 years is more than a statistical trend—it’s a reflection of deeper structural changes in the U.S. economy. In the 1960s, the post-war boom allowed for affordable housing, minimal healthcare costs, and accessible college education. These essentials were not only cheaper but also took up a smaller share of household budgets, leaving room for savings and discretionary spending.

But the trajectory changed in the late 20th century. Medical advancements, an aging population, and more complex insurance systems drove up healthcare costs. College tuition began its ascent as universities expanded and public funding declined. Housing prices also edged higher due to increased demand and urbanization.

Since 2000, the pace has only quickened. According to data cited in a recent post by Apollo’s Chief Economist using U.S. Bureau of Economic Analysis figures, hospital services have surged by 271%, college tuition by 194%, and housing prices by 108%. In contrast, overall inflation during the same period has been around 90%. This stark disparity shows that these three essentials have significantly outpaced general inflation, eating into disposable income and changing the financial landscape for many American families.

A visual representation of this trend spans from 1960 to 2025. The y-axis tracks the percentage share of total personal consumption expenditure, while the x-axis covers the time frame. The graph includes shaded bars indicating recession periods and shows a clear upward trajectory for essential spending. The most noticeable spike has occurred in the early 2020s, likely intensified by the economic pressures following the COVID-19 pandemic.

As essentials absorb a greater share of household budgets, discretionary spending is feeling the pinch. Families now have less room for leisure, travel, or retail consumption—an economic shift that reverberates across sectors like entertainment and hospitality. This change in spending patterns could also reshape industries reliant on consumer spending, making recovery difficult for small businesses and retail chains.

Beyond economics, the consequences are deeply social and political. The squeeze on middle- and lower-income households has widened income inequality, and the frustration is showing. Some younger Americans are openly questioning capitalism and exploring alternative ideologies, as noted in social media comments referencing communism and systemic policy failures.

This financial pressure is being viewed by many as a policy failure decades in the making. Issues like unregulated healthcare pricing, ballooning student debt, and restrictive housing policies have created a perfect storm. For instance, the rise in hospital costs isn’t just about better treatments—it also reflects administrative inefficiencies and opaque billing systems. In higher education, easy access to federal student loans may have encouraged universities to keep increasing tuition. In housing, restrictive zoning laws and supply shortages have pushed prices beyond the reach of many first-time buyers.

The broader implications are staggering. More Americans are turning to second jobs, gig economy work, or delaying milestones like marriage and homeownership just to stay afloat. At the same time, these pressures could influence upcoming political debates, especially as economic anxiety shapes voter behavior. With essentials taking up 37% of household budgets, it’s clear that policy reforms—especially around healthcare, education, and housing—are likely to be hot-button issues in the 2025 election cycle.

This trend isn’t just a matter of economic statistics. It’s a reflection of how the American dream is being redefined—one where essentials are no longer affordable, discretionary income is shrinking, and households are left navigating a system that no longer works for the average citizen. As this conversation continues, the pressure on policymakers to address these long-standing issues is only set to grow.

Disclaimer:

The information presented in this article is for informational and educational purposes only. It is based on publicly available data and sources believed to be reliable, including the U.S. Bureau of Economic Analysis and commentary from economic experts. However, we do not guarantee the accuracy or completeness of the data. The views and interpretations expressed are those of the author and do not constitute financial, policy, or investment advice. Readers are encouraged to conduct their own research and consult professionals before making any financial or policy-related decisions.