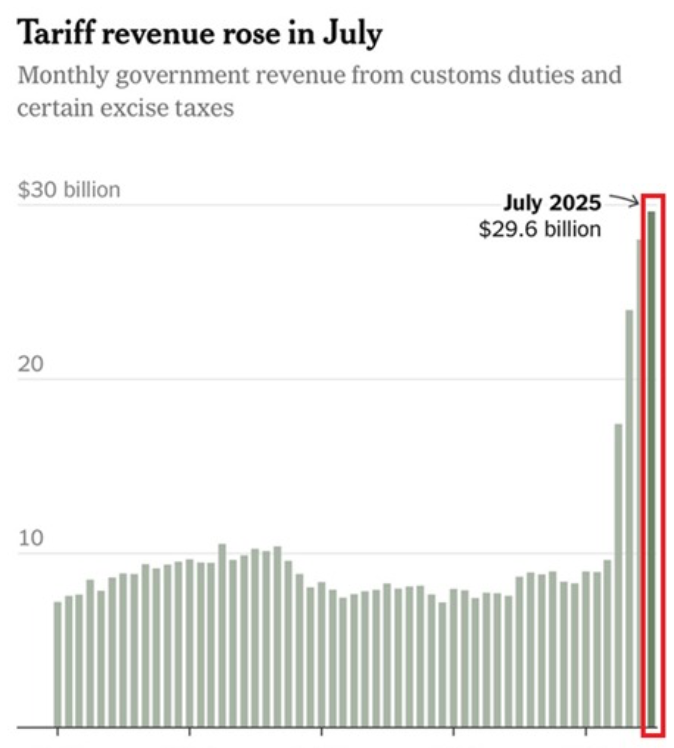

Tariff revenue in the U.S. skyrocketed to a record $29.6 billion in July 2025, marking a sharp shift in trade policy and federal revenue strategy. With $78 billion collected in just the last three months, annual tariff income could reach $308 billion—rivaling corporate taxes. This surge reflects new tariff implementations, rising import volumes, and policy changes under the Trump administration. While boosting government revenue, it may also lead to higher consumer costs and global trade tensions.

U.S. Tariff Revenue Hits Record $29.6 Billion in July

In a dramatic development in U.S. trade and fiscal policy, This revenue soared to a record $29.6 billion in July 2025. The spike marks a major departure from historical trends and suggests a structural shift in the government’s approach to generating revenue through customs duties and excise taxes.

Unprecedented Growth in Tariff Revenue

According to the latest data, U.S. government revenue from customs duties and certain excise taxes has seen a sharp and sustained rise since mid-2024, culminating in the July 2025 peak. For context, the July figure is more than triple the $8.2 billion collected in March 2025, the month when newly implemented tariffs reportedly began to take effect.

The last three months alone—May, June, and July—brought in a staggering $78 billion in revenue from these sources. The monthly breakdown is as follows:

- May 2025: $22.2 billion

- June 2025: $26.6 billion

- July 2025: $29.6 billion

To put that in perspective, this three-month revenue haul has already surpassed the total customs revenue for the entire fiscal year 2024.

Annual Forecast: A $308 Billion Revenue Stream

If the current pace continues through the rest of the year, annual revenue could reach approximately $308 billion in 2025. This would represent a $231 billion increase from the 2024 total and elevate tariffs to the status of one of the largest sources of federal income. With corporate income tax revenues totaling around $366 billion in the previous fiscal year, tariffs could soon rival them in fiscal importance.

What Are Tariffs?

Tariffs are taxes levied on imported goods by the U.S. government and collected by U.S. Customs and Border Protection under the Department of Homeland Security. These duties are often applied to specific categories of goods—such as electronics, metals, and consumer products—and may include excise taxes on items like alcohol or tobacco.

Historically, This revenue has played a minor role in the federal budget, often accounting for just about 0.3% of GDP in recent decades. The current trajectory, however, signals a potential return to the early 20th century model, where tariffs were a major revenue source before the introduction of federal income taxes.

Possible Reasons Behind the Surge

While the post does not explicitly identify the source of the recent increase, several contributing factors are likely at play:

- New Trade Policies: The Trump administration’s 2025 trade agenda may have introduced or reinstated significant tariffs on imported goods beginning in March 2025.

- Higher Import Volume: Increased trade activity with countries subject to high tariffs may have inflated the overall customs collections.

- Elevated Tariff Rates: Adjustments in duty rates on key goods such as steel, semiconductors, and consumer electronics could be feeding into the revenue growth.

Economic and Political Implications

The fiscal implications are substantial. If the projected $308 billion in revenue materializes, tariffs would become the fourth-largest source of federal income—trailing only individual income taxes, payroll taxes, and corporate taxes.

However, this revenue comes with economic trade-offs. Tariffs are typically paid by U.S. importers, who often pass the added costs on to consumers. Analysts warn this could translate into an average effective tax increase of around $1,300 per American household in 2025.

While proponents argue that tariffs can protect domestic industries and reduce trade imbalances, critics caution that such measures may lead to inflation, decreased corporate earnings, and potential retaliatory tariffs from other nations—thereby hurting U.S. exporters.

A Historical Shift in Federal Revenue Strategy

The $29.6 billion in July 2025 alone exceeds the total customs duties collected in some entire fiscal years before 2024. This marks a historic shift in U.S. fiscal policy, signaling a possible resurgence of tariffs as a central pillar of federal revenue.

As Washington increasingly leans on trade policy for both economic and strategic leverage, the role of tariffs in shaping the U.S. fiscal landscape—and potentially its global trade relations—is likely to remain in sharp focus in the months ahead.

Disclaimer:

The information presented in this article is based on publicly available data and sources believed to be reliable as of August 2025. This content is intended for informational purposes only and should not be construed as financial, investment, or policy advice. Readers are encouraged to conduct their own research and consult with qualified professionals before making any economic or political conclusions. The views expressed do not necessarily reflect those of the blog or its affiliates.