US Corporate Insiders Are Dumping Shares:US corporate insiders are offloading shares at one of the most aggressive paces in recent years, with billions of dollars in stock sold over the past 60 days even as the S&P 500 and Nasdaq hit fresh record highs. This massive wave of selling, far outweighing insider buying, raises serious questions about whether America’s “smart money” is signaling a looming slowdown, a market correction, or simply cashing in on historically high valuations after a powerful rally.

US Corporate Insiders Are Dumping Shares as S&P 500 Trades Near To All-Time Highs

US Corporate Insiders Are Dumping Shares:The US stock market has been scaling record highs in recent weeks, but behind the scenes, corporate insiders – often referred to as the “smart money” – are aggressively selling their shares. Insider trading activity data over the last 60 days reveals a striking imbalance: massive sell transactions dwarfing buy transactions, raising questions about whether these moves signal caution about the market’s sustainability.

What the Data Shows

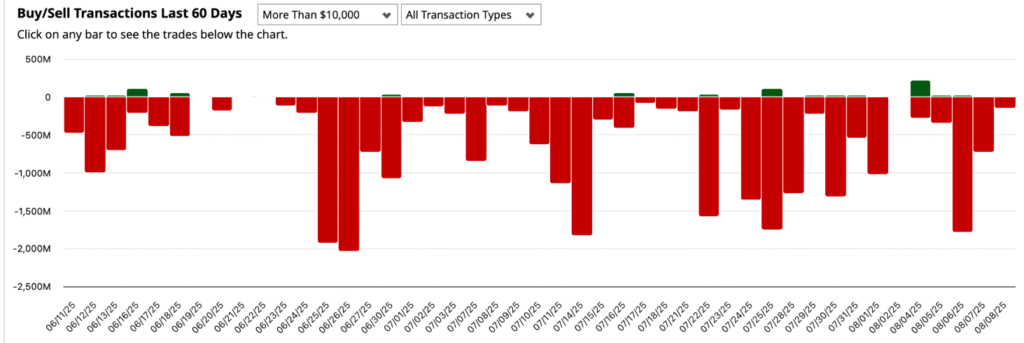

US Corporate Insiders Are Dumping Shares:The chart tracking insider buy/sell transactions of more than $10,000 over the past two months paints a clear picture. Red bars, indicating sell activity, dominate the chart, with several days showing transactions exceeding $1 billion in net sales. In some cases, net selling surged beyond $2 billion in a single day. In contrast, green bars, representing insider purchases, are sparse and relatively small, suggesting far less conviction in buying at current market valuations.

Key selling clusters occurred around mid-June, late June, mid-July, and early August. For example:

- On June 26th, 2025, insider sales spiked sharply, nearing the $2.3 billion mark.

- July 15th and July 25th each recorded heavy selling above $1.8 billion.

- Even in early August, with markets reaching new highs, corporate insiders continued offloading stock worth billions.

Why Insider Trades Matter

US Corporate Insiders Are Dumping Shares:Insider trading, in the legal sense, refers to executives, directors, and major shareholders buying or selling shares of their own companies based on publicly disclosed transactions. These insiders have access to more intimate knowledge about a company’s prospects than ordinary investors. While selling does not always mean trouble ahead, consistent and widespread dumping can indicate that insiders believe the current stock price may not be sustainable.

For example, insiders often buy before positive earnings announcements or major developments, and they sell when they believe shares are overvalued or risks are rising. Therefore, large-scale coordinated selling across sectors can be a warning signal.

Market Context – Euphoria Meets Caution

US Corporate Insiders Are Dumping Shares:The timing of this insider selling spree is critical. US equities are trading at all-time highs, with major indexes like the S&P 500 and Nasdaq pushing into uncharted territory. The rally has been fueled by strong corporate earnings, AI-driven technology optimism, and expectations that the Federal Reserve may cut interest rates later this year.

However, history shows that markets near record highs often see increased insider selling. High valuations naturally prompt executives to lock in profits, especially when share prices are inflated compared to historical averages. For instance, the price-to-earnings ratios of several high-growth technology stocks are now at levels reminiscent of the late 1990s dot-com boom.

Is This a Warning Sign?

While insider selling is not always a definitive sell signal for the broader market, the magnitude of the recent activity suggests insiders may be bracing for potential headwinds. Some of the possible factors driving this trend include:

- Economic Uncertainty – Concerns over slowing global growth, geopolitical tensions, and the impact of high interest rates may be prompting insiders to de-risk.

- Valuation Concerns – With the S&P 500’s forward P/E ratio above long-term averages, some insiders may see limited upside from here.

- Profit-Taking After a Strong Rally – Stocks have had a strong multi-month run, and insiders may be seizing the opportunity to cash out near the top.

- Sector-Specific Risks – Certain industries, such as technology and biotech, may face heightened volatility from regulatory changes or competitive pressures.

Contrasting with Buying Trends

US Corporate Insiders Are Dumping Shares:While the chart does show occasional insider buying spikes, these are few and far between. The largest buying days barely approach the $500 million mark, which pales in comparison to the multi-billion-dollar selling days. This lack of substantial buying indicates that insiders, on the whole, are not rushing to increase their stakes despite bullish market sentiment among retail investors.

What Should Investors Do?

US Corporate Insiders Are Dumping Shares:For everyday investors, insider selling should not trigger panic, but it should encourage caution. Following the “smart money” can offer valuable insights, but it is important to differentiate between routine selling (such as for tax purposes or diversification) and large-scale, market-wide selling patterns like we are currently witnessing.

Historical studies have shown that when insider selling outpaces buying by a wide margin over a sustained period, the market often experiences slower gains or even corrections in the following months. This does not mean the rally is over, but it does suggest that risks are higher.

Conclusion – Reading the Signals

US Corporate Insiders Are Dumping Shares:The ongoing wave of insider selling, at a time when the US stock market is hitting record highs, sends a subtle but important message. Corporate insiders – the people with the most intimate knowledge of their companies’ operations and future prospects – are taking chips off the table. Whether this is simply prudent profit-taking or a sign of storm clouds ahead remains to be seen.

Investors would be wise to monitor insider trading activity closely in the coming weeks. If the selling trend accelerates further and is accompanied by weakening economic data or disappointing earnings, the market could be due for a pullback. Until then, the divergence between euphoric retail investors and cautious insiders remains one of the most telling dynamics on Wall Street.