Here is What Happened in the USA Over the Weekend:Over the weekend, the U.S. witnessed a wave of historic developments—from President Trump’s sweeping pro-crypto executive orders opening the $12.5 trillion 401(k) market to digital assets, ending “debanking” practices, and the SEC settling its legal battle with Ripple, to Ethereum surpassing $4,300 and Harvard investing $116.7M in Bitcoin. With 82% of S&P 500 companies beating earnings despite tariffs, Canada facing its biggest job loss since COVID, and Dubai issuing its first crypto options license, these events could reshape global markets, accelerate mainstream crypto adoption, and redefine retirement investing for millions of Americans.

Here is What Happened in the USA Over the Weekend

The past weekend in the USA has been nothing short of historic for financial markets, crypto adoption, and policy shifts. From President Donald Trump’s sweeping pro-crypto executive orders to unexpected market resilience and international developments, investors and observers witnessed a series of events that could shape the financial landscape for years. Here’s a detailed breakdown of the top 10 developments that dominated headlines.

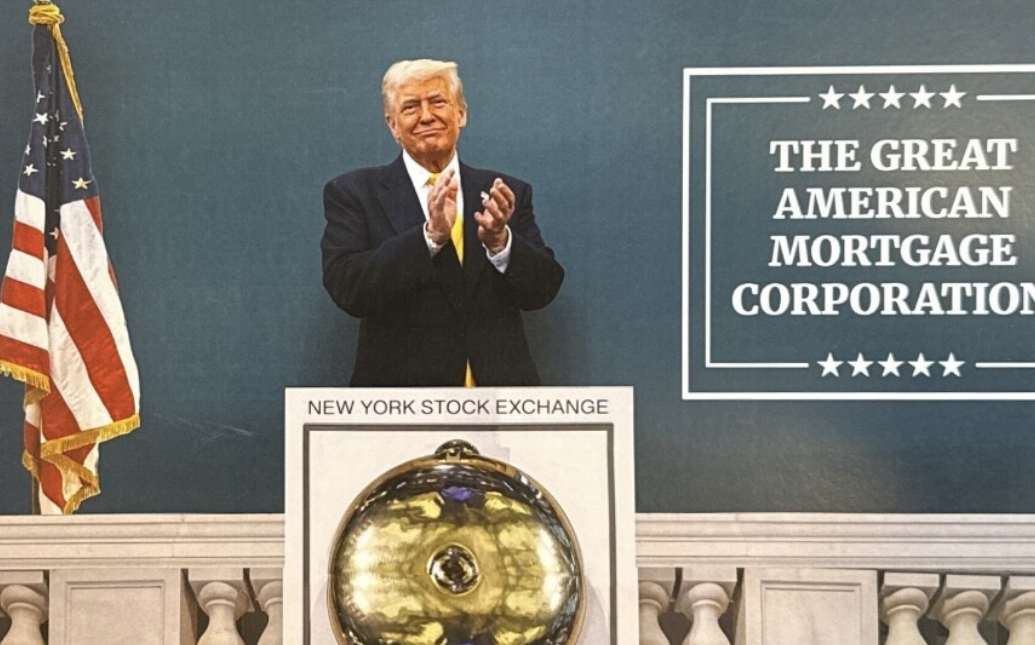

1. Trump Opens 401(k) Market to Crypto Investments

On August 7, 2025, President Donald Trump signed a landmark executive order allowing 401(k) retirement plans—worth a staggering $12.5 trillion and impacting 70–90 million Americans—to include alternative assets like cryptocurrencies, private equity, and real estate. The order directs the Department of Labor, SEC, and Treasury to revise ERISA regulations, aiming to democratize access to high-growth assets once reserved for institutional players. Bitcoin jumped 2% to $116,542 following the announcement. While proponents tout the diversification benefits, critics warn of crypto’s notorious volatility and the risks of illiquid private equity.

2. SEC and Ripple End Legal Battle

The long-running legal war between the SEC and Ripple Labs finally ended, with both sides dismissing their appeals. This comes after a 2023 ruling that XRP sales on public exchanges were not securities, though institutional sales violated securities laws. The settlement removes a major cloud over XRP, boosting investor confidence and possibly signaling a softer SEC approach toward crypto under Trump.

3. Trump Moves to End Banking Discrimination

Another major order from Trump targeted “debanking” practices, barring financial institutions from denying services based on political, religious, or crypto-related activities. This aligns with his broader push for financial freedom, a U.S. Bitcoin reserve, and relaxed regulations. The policy could encourage more banks to serve crypto firms, although implementation details remain uncertain.

4. Canada’s Largest Job Loss Since COVID

North of the border, Canada lost 40,800 jobs in July 2025—the largest drop since the pandemic. This economic weakness could pressure policymakers to launch stimulus measures or alter monetary policy. The downturn might also dampen retail investor enthusiasm, impacting sectors like crypto that benefit from discretionary spending.

5. Harvard Endowment Buys $116.7M in BlackRock’s Bitcoin ETF

In a strong show of institutional confidence, Harvard University’s endowment purchased $116,666,260 worth of BlackRock’s spot Bitcoin ETF. This move highlights a growing shift among elite institutions toward crypto exposure, offering regulated entry points to an asset class once deemed too volatile for traditional portfolios.

6. “Crypto Czar” David Sacks Says 90 Million Americans Will Gain Crypto Access

David Sacks, appointed as Trump’s “Crypto Czar,” announced that the 401(k) order would open crypto investing opportunities for 90 million Americans. A vocal critic of banks’ restrictions on Bitcoin ETFs, Sacks framed this as a monumental step for financial freedom, though he acknowledged the ongoing friction with traditional finance.

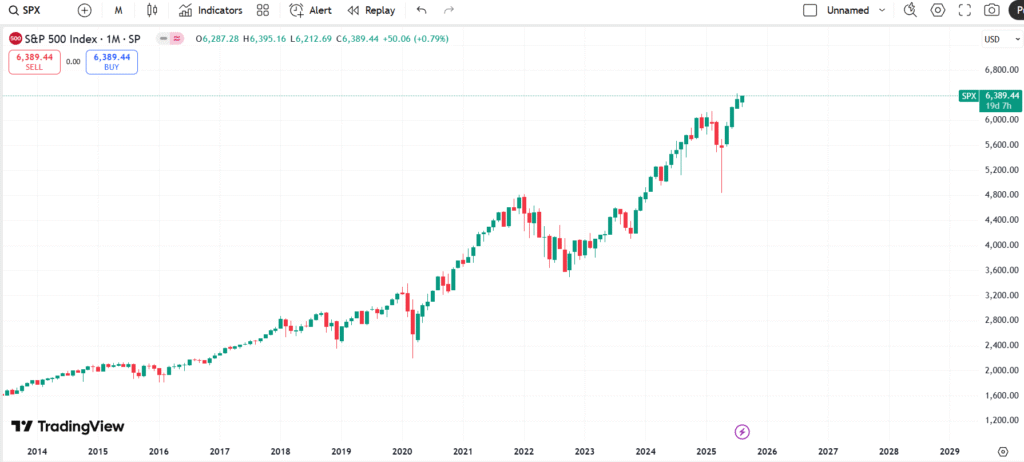

7. 82% of S&P 500 Companies Beat Earnings Despite Tariffs

Even with Trump’s new tariffs—ranging from 15% to 41% on imports—82% of S&P 500 companies exceeded Q2 2025 earnings expectations. This resilience suggests adaptability and strong demand, though economists warn tariffs could eventually squeeze profit margins.

8. SEC Declares Liquid Staking Not a Security

In another win for crypto, the SEC announced that liquid staking—where investors stake assets like ETH while retaining liquidity—would not be classified as a security. This clarity could turbocharge DeFi adoption, benefiting platforms like Lido and Rocket Pool, though security risks in decentralized protocols remain.

9. Dubai Approves First Crypto Options License

Beyond USA borders, Dubai issued its first-ever crypto options trading license, cementing its position as a global crypto hub. The move will likely attract international traders and firms, boosting derivatives market liquidity. Still, options trading’s high leverage demands caution.

10. Ethereum Crosses $4,300 for the First Time Since 2021

Ethereum surged past $4,300, its highest level since 2021, propelled by optimism over Trump’s crypto-friendly policies, DeFi expansion, and Bitcoin’s rally to $116,542. ETH’s role in powering smart contracts and NFTs remains a central draw, though its volatility means investors should brace for possible pullbacks.

Conclusion: A Weekend That Could Redefine the Markets

This weekend’s developments mark a turning point in USA economic and crypto policy. From 401(k) crypto access to regulatory clarity on staking and Ripple’s legal victory, the momentum is unmistakably pro-crypto. However, the excitement comes with risks—market volatility, evolving regulations, and economic headwinds remain part of the landscape. For investors, the message is clear: the opportunities are growing, but so are the stakes.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and stock market investments involve significant risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The views and interpretations presented are based on publicly available information at the time of writing and may change as new data emerges.USA,USA,USA,USA,USA