Berkshire Hathaway, the $800 billion conglomerate, is facing a rare 25-point underperformance against the S&P 500 after Warren Buffett announced he would step down as CEO. Since May 2nd, Berkshire’s stock has fallen 14% while the S&P 500 has risen 11%, marking its steepest lag since 2020 and even worse than during the 2008 financial crisis or 2000 dotcom bubble. Investors are now questioning the company’s future without Buffett’s leadership.

Berkshire Hathaway’s $800 Billion Giant Faces Rare 25-Point Underperformance After Buffett Exit Announcement

Warren Buffett’s Berkshire Hathaway is facing one of its steepest bouts of underperformance against the broader U.S. stock market in decades, as investors grapple with the legendary investor’s decision to step down as CEO. The recent market reaction underscores how deeply Buffett’s leadership has been intertwined with Berkshire’s valuation and investor confidence.

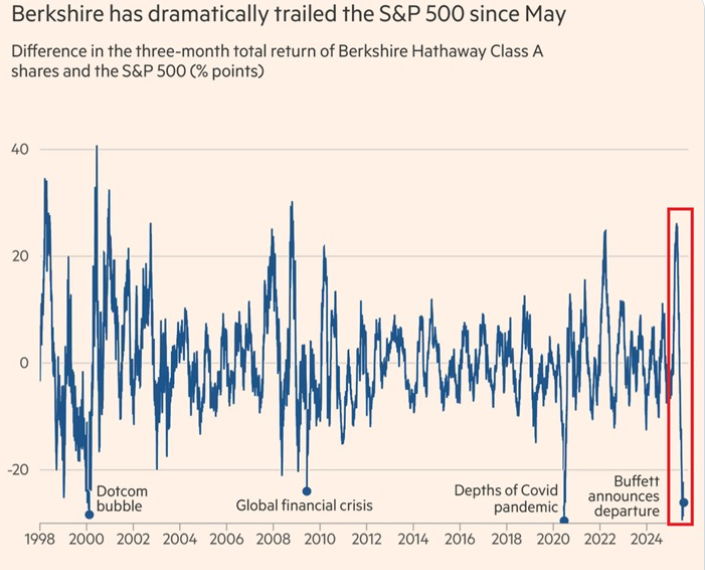

Since May 2nd, when Buffett announced that he would relinquish his role as chief executive, Berkshire Hathaway’s Class A shares have fallen by 14%. Over the same period, the benchmark S&P 500 index, including dividends, has gained 11%. This marks a staggering performance gap of around 25 percentage points — one of the widest gaps in modern Berkshire history.

Historical data shows that Berkshire has trailed the S&P 500 by similar magnitudes only on a few rare occasions over the last quarter-century. Notably, the current underperformance is even worse than during the global financial crisis of 2008 and the dotcom bubble crash of 2000. The only comparable drop in recent memory occurred in 2020, at the depths of the Covid-19 pandemic, when market panic and economic shutdowns caused extraordinary volatility.

The chart of Berkshire’s three-month total return versus the S&P 500 — stretching back to 1998 — highlights just how exceptional this current episode is. Over that 26-year span, Berkshire’s performance has fluctuated widely relative to the market, with peaks during periods of market distress and troughs during broader bull runs. Historically, Buffett’s disciplined value investing approach has often helped Berkshire outperform during turbulent times. Yet the present situation reflects a market dynamic that is as much about leadership sentiment as it is about fundamentals.

For decades, Warren Buffett has been the face of Berkshire Hathaway, shaping its investment philosophy, overseeing its diversified portfolio of businesses, and earning the nickname “the Oracle of Omaha.” Investors have often treated the company as a proxy for Buffett’s own decision-making prowess. His annual shareholder letters and patient, long-term approach to investing have become legendary in the financial world. The announcement of his departure therefore represents not just a change in management, but a symbolic end to an era.

Market analysts note that Buffett’s departure was not entirely unexpected, given his age and previous hints about succession planning. However, the sharpness of the market’s reaction suggests that investor sentiment is more fragile than many assumed. While Berkshire has a strong bench of managers — including Vice Chairman Greg Abel, who is set to take over as CEO — the market appears to be discounting a future without Buffett’s steady hand at the helm.

This underperformance also reflects a broader rotation in market leadership. Since May, technology stocks and growth-oriented companies have driven much of the S&P 500’s gains, fueled by enthusiasm over artificial intelligence, strong earnings, and easing macroeconomic concerns. Berkshire’s portfolio, while diverse, leans heavily toward value-oriented holdings such as insurance, railroads, utilities, and established blue-chip stocks. This positioning has lagged in a market environment favoring high-growth sectors.

Some analysts believe that the selloff in Berkshire Hathaway shares could present a buying opportunity for long-term investors who still believe in the company’s fundamentals. The conglomerate remains financially robust, with a massive cash reserve, profitable operating businesses, and a disciplined acquisition strategy. However, others caution that the psychological impact of Buffett’s departure could weigh on the stock for an extended period, particularly if the market perceives the new leadership as less capable of maintaining Berkshire’s historical performance edge.

Looking at past episodes of underperformance offers some perspective. In the aftermath of the dotcom bubble, Berkshire Hathaway shares initially lagged during the tech-driven boom but eventually outperformed when the bubble burst. Similarly, during the global financial crisis, Berkshire suffered in the short term but rebounded strongly in the years that followed. The pandemic-induced drop in 2020 also gave way to a sharp recovery as markets stabilized. In each case, patient investors were rewarded — though those recoveries were under Buffett’s direct leadership.

The question now is whether Berkshire Hathaway can replicate that resilience without its iconic leader. Greg Abel and the rest of the management team will need to balance continuity with adaptability, ensuring that Berkshire remains competitive in a rapidly evolving investment landscape. Strategic capital allocation, disciplined risk management, and maintaining investor trust will be paramount in the post-Buffett era.

For now, the data speaks to the extraordinary nature of the current moment. A 25-point gap between Berkshire Hathaway and the S&P 500 over a three-month period is virtually unprecedented, highlighting both the market’s confidence in Buffett and the challenges facing his successors. While Berkshire has weathered many storms in its storied history, this latest test is as much about leadership perception as it is about market cycles.

As Wall Street digests this transition, one thing is clear: the market loves Warren Buffett. His departure marks a turning point for one of the world’s most closely watched companies, and investors will be watching closely to see whether Berkshire Hathaway performance can eventually catch up to — or even surpass — the broader market once again.

This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to risks, including the possible loss of principal. Past performance is not indicative of future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions.