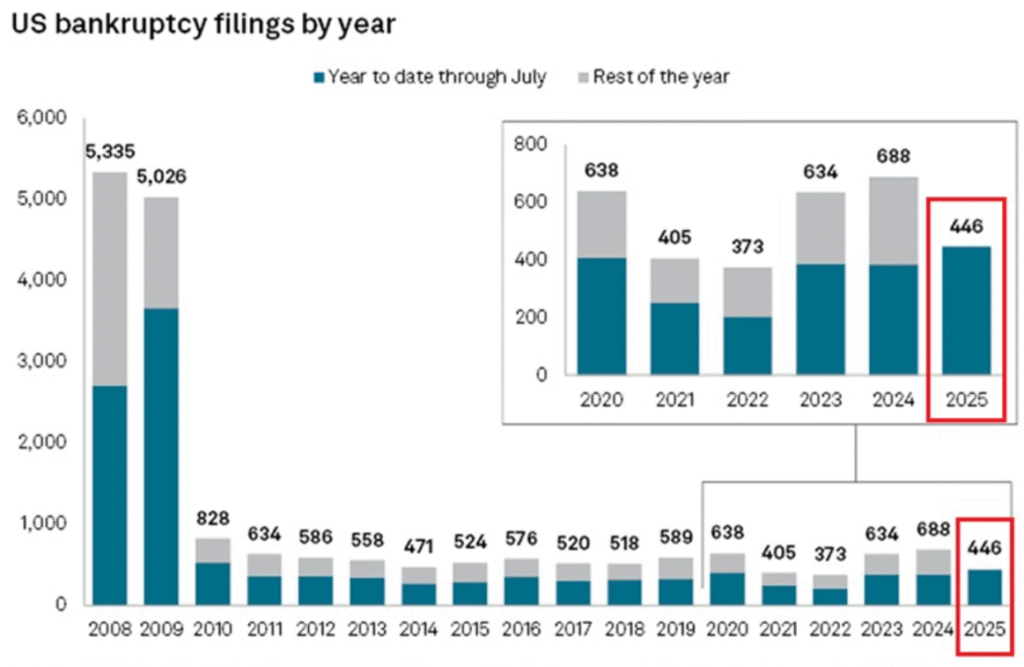

US Bankruptcy Surge in 2025:US corporate bankruptcies are surging in 2025, with 71 large companies filing in July — the highest monthly total since the pandemic year of 2020. Year-to-date filings have reached 446, already surpassing the full-year totals of 2021 and 2022, and marking the fastest pace in 15 years. Industrial and consumer discretionary sectors lead the rise, driven by high interest rates, weakened consumer spending, and economic headwinds. Analysts warn the trend could persist, pushing 2025’s total toward levels not seen since the Great Recession.

US Bankruptcy Surge in 2025, Highest Year-to-Date Total in 15 Years

In a worrying sign for the U.S. economy, the number of large company US Bankruptcies has accelerated sharply in 2025, with July marking a grim milestone. According to data compiled by S&P Global Market Intelligence, 71 large U.S. companies filed for bankruptcy protection in July alone — the highest monthly total since the peak of the COVID-19 pandemic in 2020.

The July figure surpasses the already elevated numbers from earlier this summer. In June, 66 large companies went bankruptcy, while May saw 64 filings. This consistent increase signals that the pace of corporate failures is not just high but is gaining momentum as the year progresses.

Year-to-date, 446 large U.S. companies have filed for bankruptcy through July 31, 2025. This is already the highest total in 15 years, surpassing the full-year bankruptcy counts of both 2021 and 2022, when 405 and 373 firms, respectively, went under. In other words, with five months still remaining in the year, 2025 has already recorded more bankruptcies than some recent years saw in their entirety.

The last time the U.S. saw bankruptcy numbers climb to this level was during the 2008–2009 financial crisis, when thousands of companies were forced into insolvency. While the scale of bankruptcies in 2008 and 2009 was much higher overall, the current acceleration is noteworthy given the relatively stable economic environment in recent years.

The data also reveals the industries most affected by the ongoing wave of bankruptcies. Industrial companies have led the surge in filings so far in 2025, with 70 bankruptcies. This is closely followed by the consumer discretionary sector — which includes retailers, travel companies, and leisure businesses — with 61 bankruptcies. Both sectors are facing a combination of factors, including higher borrowing costs, weakened consumer spending, and lingering supply chain pressures.

S&P Global’s historical data illustrates how significant this year’s figures are. Looking back over the past decade, most years saw bankruptcy totals well below current levels. For example, in 2018, only 520 large companies filed for bankruptcy, and in 2015 the figure was just 524. Even during the height of the pandemic in 2020, when 638 bankruptcies were recorded for the full year, the pace was more spread out.

In 2021 and 2022, bankruptcies dropped sharply as government stimulus programs, low interest rates, and a rebound in consumer demand helped keep many businesses afloat. However, that trend reversed in 2023, when 634 bankruptcies were recorded, followed by another increase in 2024 to 688. The trend in 2025 suggests the total could surpass 700 by year-end, potentially reaching levels not seen since the aftermath of the Great Recession.

Several economic headwinds are converging to create this environment. Higher interest rates, implemented to combat inflation, have made it more expensive for companies to refinance debt. Inflation, though cooling in recent months, has still eroded consumer purchasing power, especially for non-essential goods. Additionally, global economic uncertainty — from geopolitical tensions to supply chain disruptions — has added to business pressures.

The industrial sector, in particular, is feeling the brunt of these challenges. Manufacturing companies are grappling with elevated input costs and slower demand growth both domestically and in export markets. Consumer discretionary firms, especially retailers, are being hit by a pullback in household spending as Americans prioritize essential goods over luxury items and services.

Market analysts are warning that this uptick in bankruptcies could be a leading indicator of broader economic stress. If the trend continues, it may start to impact employment rates, regional economies, and investor sentiment. While large corporations tend to have more resources to weather financial difficulties, the fact that so many are failing in quick succession suggests that underlying vulnerabilities are more severe than previously thought.

The historical comparison underscores the seriousness of the current situation. In 2008, there were over 5,300 bankruptcies, followed by more than 5,000 in 2009, as the global financial system teetered. Those years remain outliers in terms of sheer scale, but the speed at which 2025’s figures are rising is drawing attention. If the current pace of roughly 60–70 bankruptcies per month continues, the final tally for 2025 could be among the highest of the past two decades.

Financial experts are closely monitoring whether this wave of bankruptcies will trigger broader consequences in credit markets. When large companies default, it can have ripple effects on lenders, suppliers, and even municipal governments that depend on corporate tax revenues. Moreover, certain industries, such as retail and manufacturing, often have significant employment footprints, meaning that continued bankruptcies could translate into job losses.

Looking ahead, some economists expect that bankruptcy filings could moderate if interest rates begin to ease in 2026. However, others caution that the economic damage from this year’s wave may already be baked in, particularly for overleveraged companies that have delayed restructuring for as long as possible.

For now, the numbers paint a stark picture: July 2025’s 71 large-company bankruptcies are the highest monthly total since the pandemic year of 2020, and the 446 year-to-date bankruptcies mark the worst start to a year in 15 years. With multiple sectors under strain and macroeconomic pressures persisting, the likelihood of a slowdown in filings before year-end appears slim.