Markets Fully Price In September Fed Rate Cut :The CME FedWatch Tool now shows a 100% probability of an interest rate cut at the U.S. Federal Reserve’s September 17, 2025 meeting, with markets expecting a 25–50 bps reduction from the current 4.25%–4.50% range. Traders see no chance of a hike or no change, signaling a clear policy pivot as the Fed responds to easing inflation and slowing economic growth.

Markets Fully Price In September Fed Rate Cut

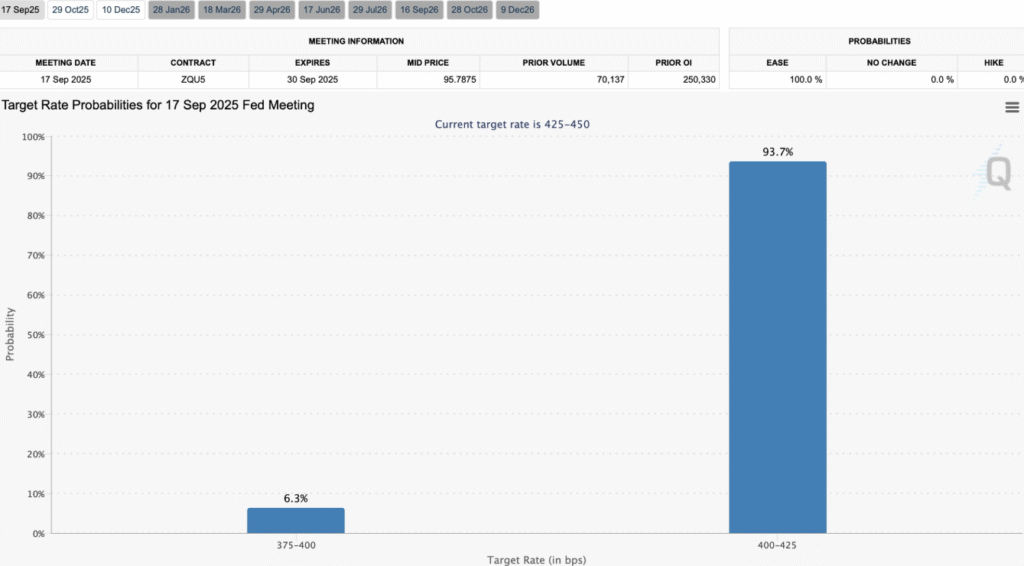

Markets Fully Price In September Fed Rate Cut:In a decisive shift in market expectations, the CME FedWatch Tool now indicates a 100% probability of an interest rate cut at the upcoming U.S. Federal Reserve policy meeting scheduled for September 17, 2025. This marks a stark consensus among traders and investors that the Fed will move to ease monetary policy next month.

Markets Fully Price In September Fed Rate Cut:According to the latest data, the current target federal funds rate stands at 4.25%–4.50%, but markets overwhelmingly anticipate a reduction. The probability breakdown shows that 93.7% of market participants expect the Fed to cut rates by 25 basis points, bringing the target range down to 4.00%–4.25%. Meanwhile, a smaller 6.3% see a deeper cut of 50 basis points, lowering the rate to 3.75%–4.00%.

Markets Fully Price In September Fed Rate Cut::Importantly, the data shows zero probability of a rate hike or no change, underscoring market certainty that the era of elevated interest rates is coming to an end. This is reflected in the ZQU5 contract, which expires on September 30, 2025, with a mid price of 95.7875. The contract’s strong trading activity—70,137 prior volume and 250,330 prior open interest—highlights intense market focus on this policy decision.

The Fed’s anticipated policy pivot is likely being driven by a combination of factors, including easing inflationary pressures, signs of slowing economic growth, and potential risks to the labor market. If delivered, this will mark the first rate cut since the central bank’s aggressive hiking cycle began in 2022 to combat surging inflation.

Investors are now watching closely for signals from Fed officials in the weeks ahead, as markets begin to price in not just a September cut, but possibly further easing into late 2025 and 2026. The decision on September 17 will be a pivotal moment for U.S. monetary policy, global markets, and the trajectory of the economy heading into the new year.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Market probabilities and forecasts are subject to change based on economic data, Federal Reserve communications, and other market conditions. Readers should conduct their own research or consult with a qualified financial advisor before making investment decisions.