U.S. Treasury Secretary Scott Bessent has set the crypto world abuzz with conflicting statements about America’s Strategic Bitcoin Reserve. First ruling out direct purchases and relying on seized assets, Bessent later hinted at “budget-neutral” acquisitions to fulfill President Trump’s pledge to make the U.S. the global Bitcoin superpower. With 198,022 BTC already valued up to $20 billion, record tariff revenues, and new asset monetization deals, the plan could reshape both U.S. economic policy and the global crypto market.

U.S. Treasury Secretary Scott Bessent Signals Possible Bitcoin Acquisitions

Washington, D.C., August 15, 2025 – U.S. Treasury Secretary Scott Bessent’s latest remarks on the U.S. government’s Strategic Bitcoin Reserve have stirred both excitement and uncertainty in the cryptocurrency market, triggering sharp price swings and renewed debate over Washington’s digital asset strategy.

Conflicting Signals from the Treasury

The controversy began on August 14, 2025, when Bessent appeared on Fox Business to discuss the reserve, which was established in March under an executive order signed by President Donald Trump. During the interview, Bessent stated that the U.S. would not actively purchase Bitcoin to expand the reserve, instead relying solely on confiscated assets from criminal and civil proceedings.

He confirmed that the reserve currently holds approximately 198,022 BTC, valued between $15 billion and $20 billion at prevailing market prices, and reiterated that the government would halt sales of its existing holdings.

However, later that same day, Bessent appeared to shift his position. In a public statement, he declared that Bitcoin forfeited to the federal government would form the foundation of the reserve and added that the Treasury was “committed to exploring budget-neutral pathways to acquire more Bitcoin” in line with President Trump’s vision of making the United States the “Bitcoin superpower of the world.”

Background on the Strategic Bitcoin Reserve

President Trump’s executive order, signed on March 6, 2025, created the Strategic Bitcoin Reserve to integrate digital assets into the nation’s broader economic framework. The reserve’s initial holdings came from Bitcoin already in federal custody through asset forfeitures.

The order also tasked Bessent and Commerce Secretary Howard Lutnick with developing “budget-neutral” acquisition strategies—methods that would not increase costs to taxpayers—for expanding the reserve. Alongside Bitcoin, a Digital Asset Stockpile for other cryptocurrencies was also established, funded through seized assets.

Market Reaction to Bessent’s Remarks

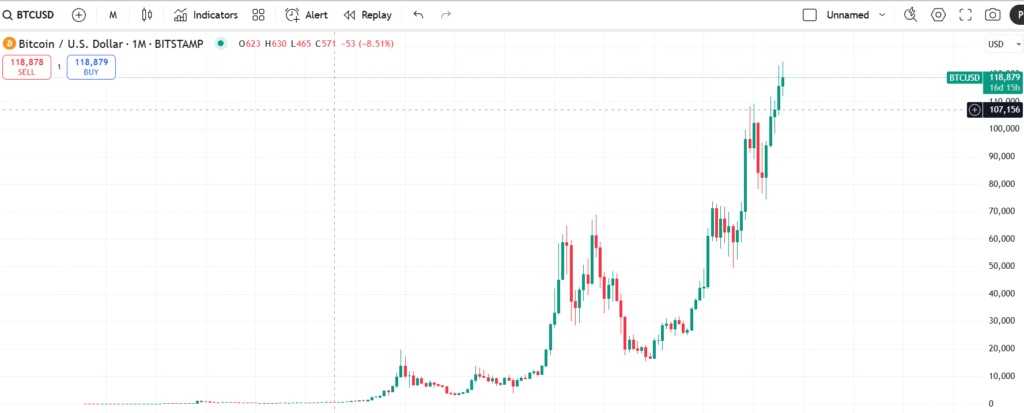

The crypto market responded swiftly to Bessent’s initial Fox Business comments. Bitcoin prices dropped from a high of $124,457 to below $119,000, with a broader market liquidation estimated at $420 million. By the end of the day, Bitcoin had fallen more than 4% to $117,550, and other major cryptocurrencies, including Ethereum, experienced similar declines.

His subsequent statement hinting at potential budget-neutral acquisitions sparked a partial rebound in sentiment. While some market participants interpreted the remarks as a positive sign for long-term Bitcoin adoption, others remained cautious, citing the absence of specific implementation details.

Economic Context and Possible Funding Sources

Bessent’s comments on the Strategic Bitcoin Reserve came alongside broader economic updates. He reported record tariff revenues of over $28 billion in July 2025, making tariffs the third-largest revenue source for the U.S. government. Annual tariff income, he projected, could surpass $300 billion, potentially helping reduce the federal deficit-to-GDP ratio from 6.5%–6.7% to the administration’s target of 3%.

These revenues could theoretically support budget-neutral Bitcoin purchases, although Bessent did not confirm whether tariffs would be used for this purpose. He also cited other asset monetization initiatives, such as agreements with semiconductor giants NVIDIA and AMD, which will contribute 15% of their China sales in exchange for export licenses.

Framing these policies as part of a broader balance sheet strategy, Bessent emphasized prioritizing asset creation over new debt issuance.

Unanswered Questions and Next Steps

The Treasury has yet to release further clarification on Bessent’s latest statement, and earlier deadlines for reporting on budget-neutral acquisition strategies—originally due in May 2025—passed without public updates.

The uncertainty has left both investors and analysts speculating about the government’s true intentions. Potential acquisition pathways could include reallocating existing federal assets, using tariff revenues, or leveraging other non-debt funding mechanisms.

Amid this ambiguity, the Strategic Crypto Reserve remains a focal point for the crypto community. With the U.S. national debt now exceeding $37 trillion, interest in Bitcoin as a hedge against inflation has intensified. Bessent’s previous calls for “bringing Crypto onshore” and halting the sale of seized assets suggest a shift toward treating Bitcoin as a strategic national holding—what some have described as a “digital Fort Knox.”

Disclaimer:

This article is for informational purposes only and is based on publicly available statements, reports, and market data as of August 15, 2025. It does not constitute financial, investment, or legal advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The views and interpretations presented are solely for news and analysis purposes.