Tesla’s board has proposed a record $1 trillion performance-based pay package for Elon Musk, tied to ambitious milestones including a $8.5 trillion market cap, 20 million annual EV deliveries, 1 million robotaxis, and 1 million Optimus humanoid robots. Shareholders will vote on November 6, 2025, in a move that could reshape Tesla’s future as an AI and robotics giant while raising governance concerns.

Tesla’s Board Proposes $1 Trillion Pay Package for Elon Musk

Tesla’s board of directors has unveiled a historic compensation plan for CEO Elon Musk, valued at up to $1 trillion, making it the largest corporate pay package ever proposed. The plan, filed in Tesla’s proxy statement on September 5, 2025, is entirely performance-based and will be put to a shareholder vote at the company’s annual meeting on November 6, 2025. This groundbreaking proposal reflects both Tesla’s ambition to transform itself into a global leader in artificial intelligence, robotics, and autonomous mobility, as well as the board’s determination to retain Musk amid growing competition and internal challenges.

The proposed package is structured very differently from conventional executive compensation plans. Musk will not receive any salary or cash bonuses. Instead, the deal offers him up to 423.7 million Tesla shares, distributed in 12 tranches, provided the company meets a series of highly ambitious milestones. If achieved, the value of these shares could reach approximately $975 billion to $1 trillion, based on Tesla’s projected market capitalization of $8.5 trillion.

If Musk earns the full award, his stake in EV Maker would increase from 13 percent to nearly 25 to 29 percent, dramatically strengthening his voting control over the company. This addresses his long-standing demand for greater influence to safeguard his leadership from activist shareholders. Importantly, Musk will be able to exercise voting rights on awarded shares immediately, though he will face restrictions on selling them for several years.

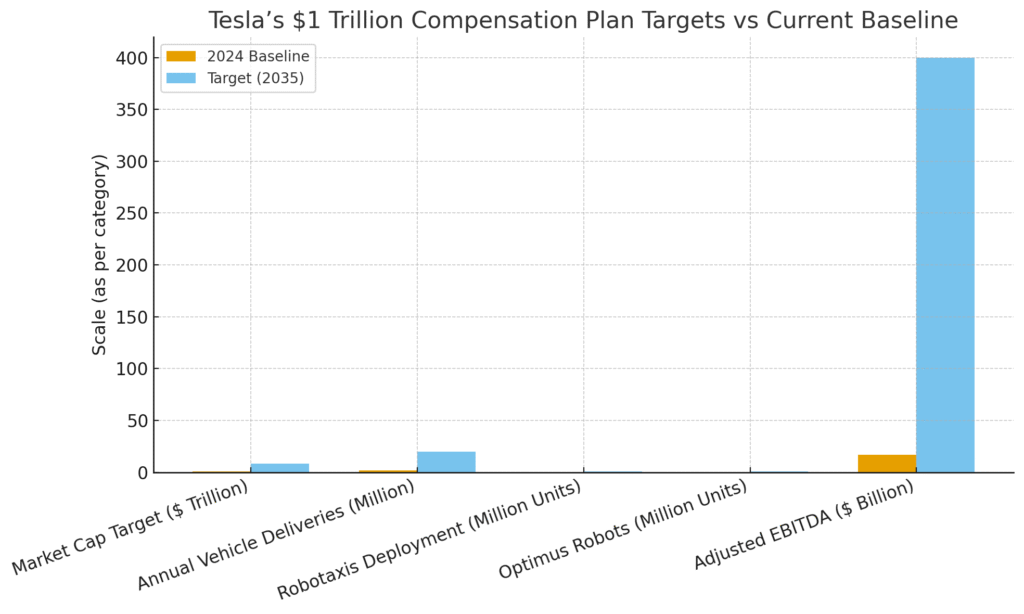

The compensation plan is tied to a mix of market capitalization targets and operational goals. The first tranche would vest once Tesla reaches a $2 trillion valuation, with subsequent tranches requiring further growth up to $8.5 trillion. On the operational front, Tesla must scale its annual vehicle deliveries to 20 million, a huge leap from the 1.8 million delivered in 2024. In addition, EV Maker must deploy 1 million fully autonomous robotaxis, reflecting Musk’s vision of creating a global ride-hailing network that combines features of Airbnb and Uber. Another milestone is the production and delivery of 1 million Optimus humanoid robots, which Musk claims could account for up to 80 percent of Tesla’s future value.

Financial performance is also a key metric, with EV Maker required to achieve an adjusted EBITDA of $400 billion, compared to just $17 billion in 2024. The plan also includes a succession component: Musk must outline a clear framework for leadership continuity in the final two tranches. The package spans 10 years, requiring Musk to remain as CEO or in another key role for at least 7.5 years to begin vesting and the full 10 years to realize the entire award.

This proposal comes against the backdrop of EV Maker past compensation battles. Musk’s 2018 plan, initially valued at $2.6 billion but ultimately worth as much as $56 billion, was struck down by a Delaware court in 2024 after a shareholder lawsuit alleged conflicts of interest. Tesla has since reincorporated in Texas and adjusted its bylaws, requiring challengers to hold at least 3 percent of Tesla’s stock, effectively minimizing legal challenges. In the meantime, Musk was granted an interim 2025 package worth $29 billion in stock to ensure his continued leadership.

Tesla’s board has framed this new plan as vital to its strategic pivot from being just a carmaker to becoming a diversified technology powerhouse. The company is betting heavily on its AI-powered Full Self-Driving technology, robotaxis, and humanoid robotics. In 2024, Tesla unveiled its Cybercab prototype, a two-seater fully autonomous vehicle without a steering wheel or pedals, targeting mass production in 2026. Musk has also projected that Optimus robots will enter limited factory use in 2025 before being sold commercially in 2026.

However, experts are skeptical of Tesla’s ability to hit these aggressive targets. Tesla is already facing declining EV sales, including a 40 percent drop in Europe in July 2025, along with increasing competition from Chinese automakers like BYD. In robotics, firms such as Boston Dynamics and Figure AI are considered to have significant leads. Tesla also trails Waymo, which had already recorded 10 million paid robotaxi trips by May 2025.

Adding to these operational challenges are Musk’s political controversies. His outspoken support for Donald Trump, far-right parties, and controversial commentary on social media has alienated some Tesla customers, contributing to boycotts and a 45 percent drop in Tesla’s market capitalization since December 2024.

Investor reactions to the new package have been mixed. Supporters argue that the plan aligns EV maker compensation directly with Tesla’s performance and could unlock massive value for shareholders if the targets are met. Analysts like Dan Ives of Wedbush Securities emphasize that Musk’s leadership is critical to Tesla’s ambition to dominate the AI and robotics industries. On the other hand, critics warn of significant shareholder dilution from issuing nearly 424 million new shares and highlight the risks of Musk’s growing concentration of power. Governance experts also express concerns about Musk’s ability to commit sufficient time to Tesla given his involvement in other ventures such as SpaceX, xAI, Neuralink, and The Boring Company.

The November 6 shareholder vote will serve as a referendum on both Musk’s leadership and Co’s future direction. While Musk’s past ambitious targets were once met against all odds, the unprecedented scale of this plan sets a much higher bar. If successful, Tesla could not only cement its dominance in electric vehicles but also redefine the future of robotics and autonomous transport. If unsuccessful, the plan risks deepening governance disputes and damaging investor confidence.

EV maker’s proxy filing also includes other proposals, such as whether EV maker should take a stake in Musk’s AI venture, xAI, which recently acquired X (formerly Twitter). This raises concerns about conflicts of interest but could further integrate Musk’s business empire. The board has also recommended rejecting a proposal for a political neutrality policy, signaling that Tesla is willing to tolerate Musk’s outspoken political activity despite its impact on the brand.

This $1 trillion pay package represents more than just executive compensation. It is a bet on Musk’s vision, leadership, and ability to deliver on the most ambitious corporate roadmap in history. Shareholders now face a defining choice: whether to back Musk’s dream of transforming Tesla into the world’s most valuable company or to resist what critics see as an unprecedented consolidation of power in one individual.