Long-term unemployment in the U.S. has surged to 1.94 million in August 2025, the highest since November 2021. The share of Americans unemployed for over 27 weeks has climbed to 26.3%, more than doubling since December 2022. This rise signals deep cracks in the job market, with levels now higher than past recessions except 2008 and 2020.

The number of long-term unemployement of Americans jumped to 1.94 million in August

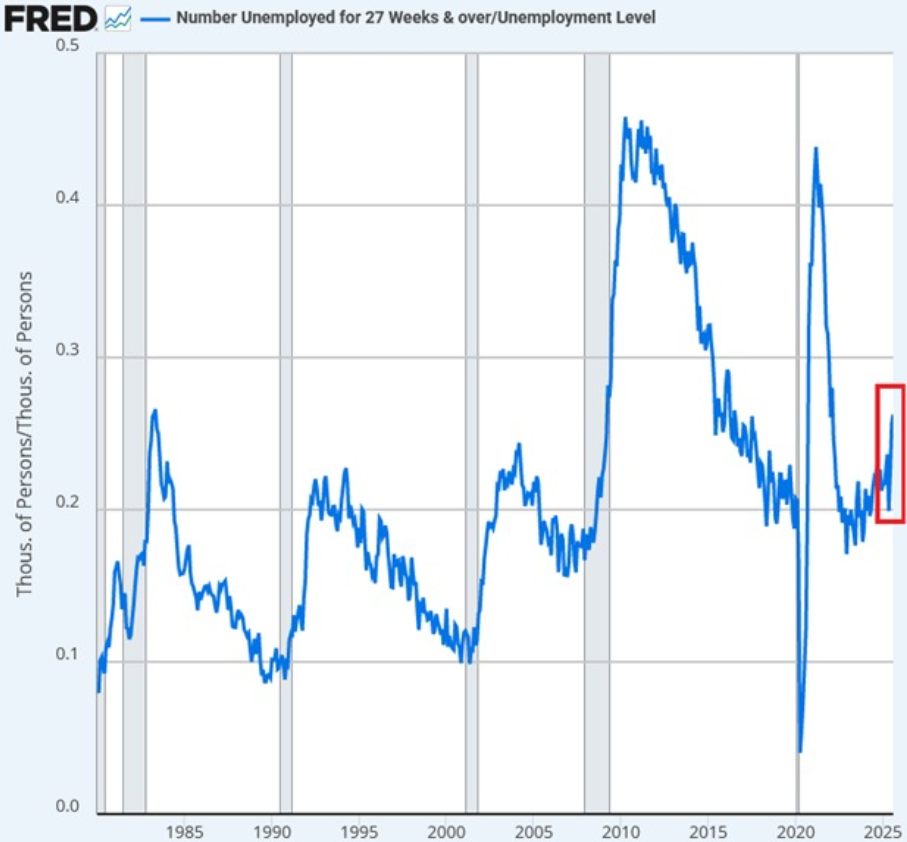

The United States job market is showing worrying signs of weakness as long-term unemployment continues to surge at an accelerated pace. Recent data from the Federal Reserve Economic Data (FRED) highlights that the number of Americans who have been unemployed for 27 weeks or more has risen sharply, raising concerns about the overall health of the labor market and its resilience in the face of economic uncertainty.

According to the latest figures, the number of long-term unemployed Americans reached 1.94 million in August, marking the highest level since November 2021. This significant increase reflects the mounting challenges faced by job seekers who are struggling to reenter the workforce after extended periods of joblessness.

What is particularly concerning is the rapid pace at which this figure has grown. Since December 2022, the number of people unemployed for more than 27 weeks has more than doubled. Such a steep rise in less than two years suggests that underlying weaknesses in the labor market are worsening, even as broader unemployment levels may not fully capture the depth of these struggles.

Another troubling development is the rising share of long-term unemployed as a proportion of the overall unemployed population. In August, this share surged to 26.3 percent, the highest level since February 2022. This represents nearly a 10 percentage point increase in just 20 months, highlighting how quickly the job market has deteriorated for those experiencing extended unemployment spells.

To put this in perspective, the percentage of unemployed individuals who have been without work for 27 weeks or longer is now higher than in all previous recessions, excluding the 2008 global financial crisis and the 2020 pandemic-driven downturn. Historically, long-term unemployment tends to peak during or immediately after recessions, but the current trend indicates a structural challenge that extends beyond temporary economic cycles.

The chart provided by FRED illustrates this concerning trend. Over the past four decades, long-term unemployment as a share of total unemployment has fluctuated with the business cycle, spiking during economic downturns and gradually easing during recoveries. However, the sharp and sustained rise since late 2022 suggests that the United States is facing deeper labor market issues.

Several factors may be contributing to this rise in long-term unemployment. First, technological advancements and automation are reshaping industries, leaving many workers with outdated skill sets. As employers increasingly demand specialized skills, job seekers who have been out of the workforce for extended periods often find it difficult to compete.

Second, economic uncertainty, inflationary pressures, and tighter monetary policy have slowed hiring activity, making it harder for displaced workers to find new employment opportunities. Third, structural shifts in certain sectors, such as manufacturing and retail, have reduced the availability of stable, well-paying jobs, disproportionately affecting workers with less education or training.

The consequences of prolonged unemployment are far-reaching. Individuals who remain out of work for more than six months often face declining skills, reduced confidence, and stigma from employers who may view long gaps in employment negatively. This creates a vicious cycle where the longer someone is unemployed, the harder it becomes for them to reenter the workforce. On a broader scale, persistently high levels of long-term unemployment can weaken consumer spending, strain social safety nets, and drag down overall economic growth.

Policymakers and economists are now closely watching these trends, as rising long-term unemployment could signal deeper cracks in the job market. Addressing the issue may require a combination of policy measures, including targeted job training programs, incentives for businesses to hire long-term unemployed individuals, and broader economic strategies to stimulate job creation in high-growth sectors.

While the headline unemployment rate often garners the most attention, the sharp increase in long-term unemployment reveals a more troubling reality beneath the surface. Millions of Americans are not just unemployed, but stuck in a prolonged struggle to regain employment, raising questions about the durability of the U.S. labor market recovery.

Unless steps are taken to address this growing challenge, the rise in long-term unemployment could weigh heavily on economic stability and the livelihoods of millions of families. The data is clear: the U.S. job market is declining in ways that should not be ignored, and the urgency to act is greater than ever.