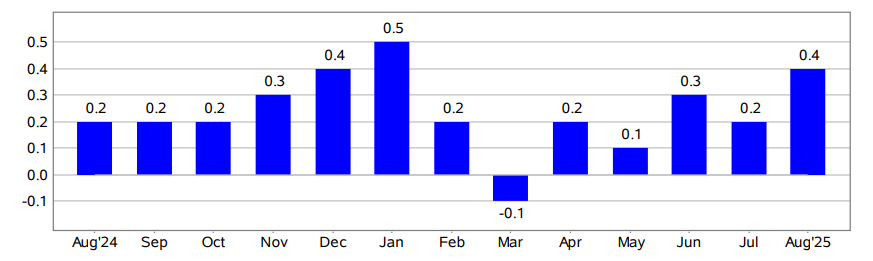

U.S. inflation rose 0.4% in August 2025, driven by higher shelter, food, and energy costs. Annual CPI inflation climbed to 2.9%, with core inflation steady at 3.1%. The latest data shows persistent housing pressures, rising grocery bills, and volatile energy prices as the Federal Reserve weighs policy moves.

U.S. Inflation Accelerates to 0.4 Percent in August

Washington, D.C., September 11, 2025 — Inflation in the United States gathered momentum in August as consumer prices rose at a faster pace than in July. According to the latest release from the U.S. Bureau of Labor Statistics (BLS), the Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.4 percent on a seasonally adjusted basis in August, following a 0.2 percent increase in July. Over the past 12 months, the all-items index has risen 2.9 percent before seasonal adjustment, up from the 2.7 percent annual gain reported in July.

The August report shows that shelter costs, food prices, and energy were the primary drivers behind the acceleration, while some categories such as medical care, recreation, and communication provided modest downward pressure.

Shelter costs continue to push inflation higher

The shelter index once again emerged as the single largest contributor to monthly inflation. In August, shelter prices rose 0.4 percent, reflecting continued pressure in both the rental and ownership markets. Persistent high demand, coupled with limited rental availability and elevated mortgage rates, has kept housing inflation sticky. Shelter costs have been one of the strongest contributors to annual inflation over the past year, and August’s increase reinforced its outsized role in the consumer price picture.

Food prices post steady gains

Food inflation picked up in August, with the overall food index climbing 0.5 percent. Within this category, food at home, which captures grocery prices, increased 0.6 percent after being relatively flat in the earlier summer months. Higher grocery bills reflect increases across categories such as dairy, cereals, and fresh produce. Food away from home, which measures restaurant and dining prices, also advanced, rising 0.3 percent during the month.

On a year-over-year basis, food prices have risen 3.2 percent. Food at home is up 2.7 percent over the last 12 months, while food away from home is showing stronger momentum with a 3.9 percent gain compared to August 2024.

Energy prices turn upward

Energy costs were another key factor in August, reversing the declines seen earlier in the summer. The overall energy index rose 0.7 percent during the month, supported by higher gasoline prices. Gasoline prices jumped 1.9 percent in August, driving much of the monthly gain. Fuel oil prices dipped slightly by 0.3 percent, while electricity rose 0.2 percent. Natural gas, however, showed a steeper monthly increase of 1.6 percent, extending its strong run.

For the 12 months ending in August, the energy index has gained 0.2 percent. Within this, energy services such as electricity and piped gas showed much stronger gains, with electricity up 6.2 percent and utility gas service up 13.8 percent year over year. In contrast, gasoline prices were down 6.6 percent over the same period, highlighting the volatility in energy markets.

Core inflation holds steady

The index for all items less food and energy, commonly referred to as core inflation, rose 0.3 percent in August, the same pace as in July. This steady increase underscores the broad-based nature of price pressures outside of the more volatile food and energy categories.

Indexes that rose during the month include used cars and trucks, which gained 0.5 percent after several months of decline, apparel, which edged up 0.5 percent, and new vehicles, which rose 0.3 percent. Airline fares also saw an uptick, adding to transportation costs.

On the downside, some categories registered declines. Medical care services fell 0.8 percent in August, while the medical care commodities index slipped 0.2 percent. Recreation and communication also declined modestly.

Annual inflation trends

Looking at the broader picture, inflation remains moderate compared to the spikes seen in previous years. The all-items index rose 2.9 percent over the 12 months ending August, slightly higher than the 2.7 percent annual increase reported in July. Core inflation, measured by the all-items less food and energy index, registered a 3.1 percent year-over-year rise.

Energy prices overall have been subdued over the year, rising just 0.2 percent despite the volatility in monthly movements. Food prices, however, remain elevated, with an annual increase of 3.2 percent.

Not seasonally adjusted measures

On a not seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) increased 2.9 percent over the past year, reaching an index level of 323.976 (1982-84=100). For the month of August, the index increased 0.3 percent prior to seasonal adjustment.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) also rose, increasing 2.8 percent over the past year to an index level of 317.306. For the month, it also recorded a 0.3 percent increase prior to adjustment.

The Chained Consumer Price Index for All Urban Consumers (C-CPI-U), which accounts for changes in consumer spending patterns, rose 2.7 percent over the past year. On a monthly basis, it too increased 0.3 percent on a not seasonally adjusted basis. The BLS noted that these chained indexes for the past 10 to 12 months are subject to revision.

Outlook and implications

The August data suggests that while inflation has moderated significantly from the multi-decade highs of 2022 and 2023, certain categories continue to exert upward pressure. Shelter remains the most persistent driver, while food and energy fluctuations continue to influence monthly figures.

The Federal Reserve will be closely monitoring these trends as it balances its monetary policy decisions. While the annual pace of 2.9 percent is within striking distance of the Fed’s 2 percent target, the stickiness of shelter and core services inflation may keep policymakers cautious. Markets will also be watching closely for signals from the Fed regarding future interest rate adjustments, as August’s data provides both relief and caution.

In summary, U.S. inflation ticked higher in August to 0.4 percent month-on-month, with annual inflation rising to 2.9 percent. Shelter and energy were the primary forces behind the increase, while food prices added to household expenses. Although the broader picture shows inflation moderating, the persistence of housing costs and core services continues to challenge policymakers, businesses, and consumers alike.

Disclaimer:

The information provided in this article is based on data released by the U.S. Bureau of Labor Statistics and other publicly available sources. It is intended for informational and educational purposes only and should not be considered as financial, investment, or economic advice. Readers are encouraged to consult professional advisors before making any financial or policy-related decisions.