US Bond Market:The world’s biggest bond market is sounding increasingly louder alarms over the United States’ worsening fiscal situation, particularly in response to President Donald Trump’s latest tax legislation. Investors are growing nervous as the implications of this “beautiful” tax bill begin to unfold.

US Bond Market Raises Alarms Over Trump’s Fiscal Moves

The world’s largest bond market is issuing increasingly urgent warnings about the United States’ deepening fiscal troubles. At the heart of the concern is President Donald Trump’s newly passed tax bill, which could add trillions of dollars to the national debt and unsettle global investors.

Charles Gasparino is a FOX Biz Senior Correspondent, NY Post columnist & author of Go Woke Go Broke, Says: “With the bond market tanking, investors I speak to say the administration should be on notice about it’s broader economic agenda. It’s not tax cuts that are spooking the bond vigilantes–they’re baked in because this is merely an extension of the Trump 1 tax policy. But more to the point, the ruction is a combination of still aggressive spending and a tax increases in the form of tariffs that could have the opposite effect of most tax increases in the short run ie producing inflation because of it’s price-shock characteristics before they slow growth. To be sure, Trump was left with a mess from the overspending of the Biden years, particularly the fiscal time bomb left in the form of massive short-term borrowing to suppress interest rates and get Kamala Harris elected. But the tariff plan could negate any supply side push that Trump’s deregulation and tax cuts would spur. Then youre left with a still bloated spending plan with weak growth. That’s a sell signal for bonds, I am told.”

Bond Market Reacts to Narrow Passage of Trump’s Tax Bill

President Trump’s flagship tax bill narrowly passed the 435-member House of Representatives by a single vote. This massive, multi-trillion-dollar package is expected to significantly increase the country’s nearly $37 trillion national debt. It proposes major cuts to safety net programs like Medicaid while focusing on extending tax cuts — a shift that has raised eyebrows across the financial community.

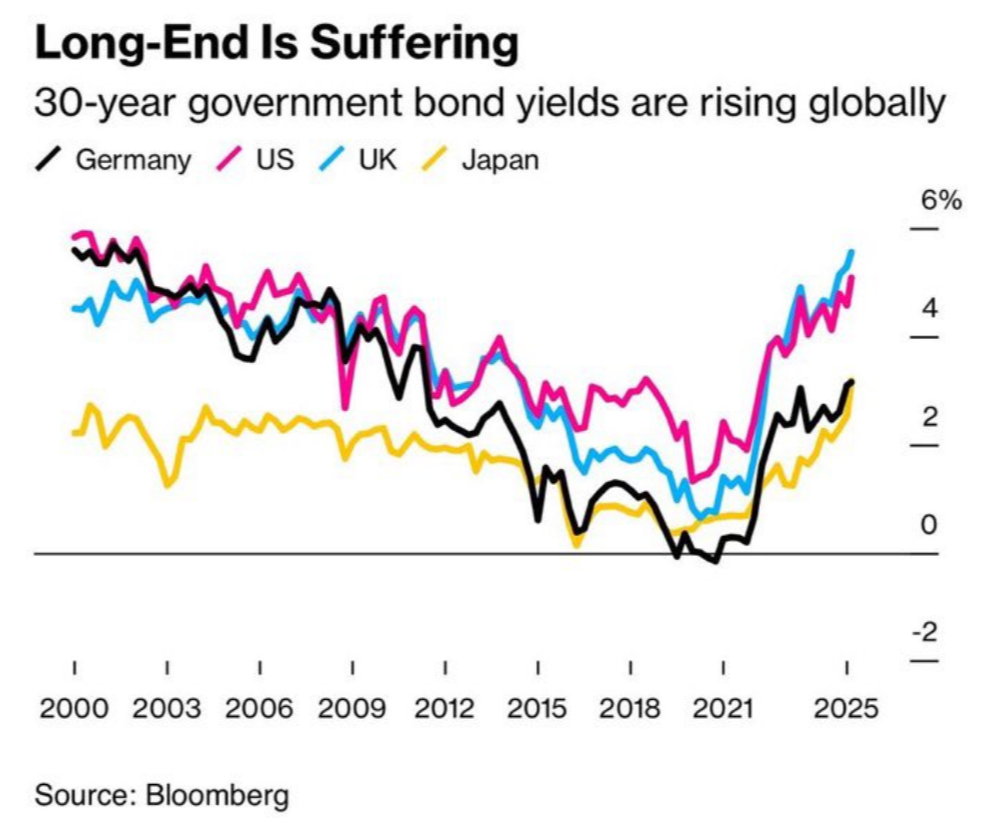

US stocks and long-term bonds fell after a weak $16 billion sale of 20-year Treasuries raised worries about Trump’s tax plan. The 30-year bond yield jumped 2.40% to 5.086%, the highest since late 2023. S&P 500 dropped 1.2%

Investor sentiment towards US Treasuries has deteriorated due to a tax bill that may add trillions to the federal deficit, leading to a surge in Treasury yields and a decline in the dollar and stocks.

Bond Market Uncertainty as Bill Heads to the Senate

With the bill now moving to the Senate — also narrowly controlled by Republicans — its final shape remains uncertain. Investors are on edge, wondering if the more extreme provisions will survive Senate revisions. However, even a moderated version is unlikely to ease market jitters. The bond market views this as a sign of potential long-term instability.

Weak Treasury Auctions Deepen Bond Market Sell-Off

Investor sentiment toward U.S. Treasuries took a major hit after Moody’s downgraded the U.S. credit rating last week. That concern deepened further following a weak auction of 20-year bonds on Wednesday, which drew surprisingly low demand. This sparked a fresh wave of selling in the bond market, reflecting fears about America’s growing fiscal burden.

Why does this matter? Because U.S. Treasuries are the foundation of the global financial system. They’re considered “risk-free” meaning everything from mortgage rates to stock valuations is built off their yields. When yields jump, the cost of money everywhere rises. The U.S. government is issuing record levels of debt just as the Federal Reserve has stepped back from being a buyer.

Bond Market Yields Hit Pre-Crisis Highs

Current Treasury yields are hovering between 4% and 5%, levels last seen before the 2008 financial crisis. For over a decade, borrowing costs remained relatively low. But now, with debt and deficits at historically high levels, the U.S. is paying much more to borrow — and the bond market is taking notice.For the first time since April 9th, equity markets are beginning to react to higher yields. With the 10Y Note Yield now above 4.50%, and 80+ bps above pre-“Fed Pivot” levels. Mortgage rates are back above 7%, auto loans are crossing 10%, and credit card rates are above 20%. “Higher for longer” is back for the 100th time.

Currency Pressure Mounts as Bond Market Warnings Persist

Steven Barrow from Standard Bank warned that if fiscal concerns remain unresolved, the U.S. dollar may suffer further. The dollar is already down nearly 1% this week and over 7% for the year, its worst start since 2005. Much of this is tied to the bond market’s deteriorating confidence in U.S. fiscal management.

The bond market has become a key battleground in evaluating Trump’s fiscal policies. As uncertainty rises over how the Senate will respond to the House tax bill, both investors and analysts are bracing for more volatility. Whether these warnings lead to policy changes or further market disruptions remains to be seen.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or tax advice. The views expressed are based on current market developments and publicly available information. Readers are advised to consult with a qualified financial advisor before making any investment decisions. The author and the website do not take responsibility for any financial losses resulting from investment decisions made based on this article.