LVMH, the world’s largest luxury goods company, reported a 4% drop in sales and a sharp 9% decline in its core fashion and leather goods segment. This signals a broader transformation in global luxury consumption, with wealthy elites still splurging while aspirational buyers pull back. Here’s what it means for the luxury market.

LVMH reported a 4% overall decline in sales, driven by a steep 9% fall in its core fashion and leather goods division

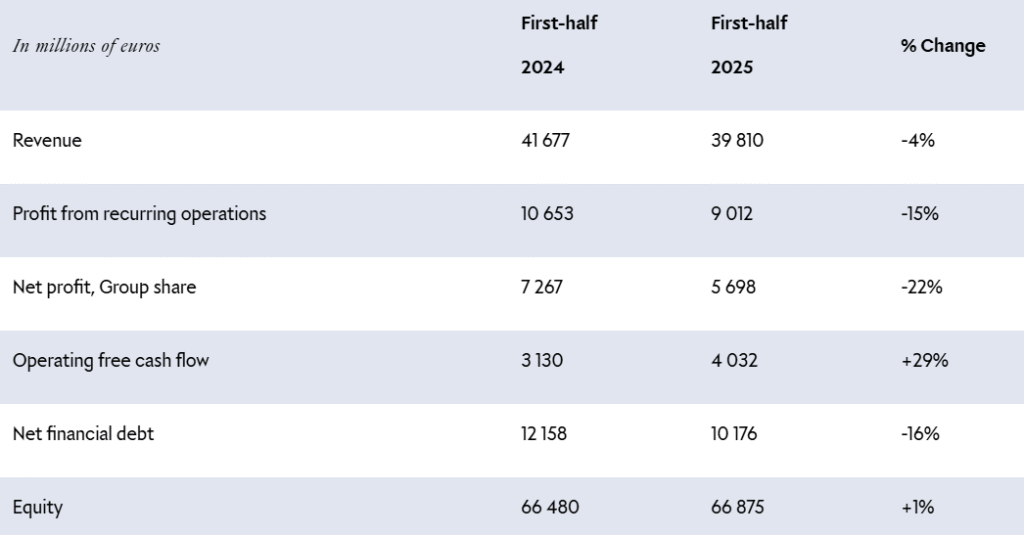

In its latest quarterly results, Louis Vuitton’s parent company LVMH reported a 4% overall decline in sales, driven by a steep 9% fall in its core fashion and leather goods division. The weak quarter surprised many and briefly pushed LVMH’s stock lower before a rebound, driven largely by optimism around the Chinese market.

The luxury giant cited multiple factors for its underwhelming performance, including a weak macroeconomic environment, currency fluctuations, and soft demand in China—its most critical market, contributing nearly one-third of its revenue. Interestingly, while demand from the U.S. market remained flat, it was supported by strong performance from Sephora, the beauty retailer owned by LVMH, and robust sales of champagne.

Luxury investors now have their eyes on upcoming earnings from Kering and Hermès. While Kering continues to struggle with its flagship brand Gucci, Hermès is expected to perform well, thanks to its appeal to ultra-high-net-worth individuals. This reflects a deeper segmentation in the luxury sector, with a clear divide between top-tier luxury consumers and aspirational buyers who are becoming more cost-conscious.

Despite the broader macro weakness, luxury brands that serve the wealthiest consumers continue to thrive. Ralph Lauren recently hit an all-time high, Richemont reported a 6% rise in jewelry sales, and Brunello Cucinelli reaffirmed its forecast of 10% sales growth. At the ultra-high-end, Hermès has now surpassed LVMH in market capitalization, despite generating only one-fifth the sales. This is largely attributed to the high desirability and exclusivity of products like the Birkin bag, which continue to drive immense value.

This divide underscores the so-called “K-shaped recovery” in the global economy, where wealthy individuals continue to spend aggressively, while middle and lower-income consumers cut back. Even within the luxury segment, there’s a growing contrast between elite brands like Hermès and Cucinelli, and more broadly targeted labels like Dior and Gucci, both of which are showing signs of strain.

China remains a focal point in LVMH’s turnaround hopes. The company is optimistic about a recovery in Chinese luxury demand, spurred by a shift in consumer shopping patterns—from Japan back to China due to currency dynamics like a weaker yen. However, some analysts remain skeptical, noting that recent changes have not yet translated into significant sales gains.

Interestingly, this trend extends beyond fashion. Coca-Cola also reported signs of improving stability in China, suggesting a broader shift in consumer sentiment, albeit gradual and uneven.

In a related development, the art market—a traditional barometer of ultra-wealthy spending—has not kept pace with rising financial wealth. Auction sales have dropped by more than 20% over the past two years. Experts suggest this is due to shifting preferences among younger rich collectors, who are less interested in classic blue-chip paintings and more drawn to alternative luxury items like handbags, rare watches, and sports memorabilia.

The art market’s apparent disconnect from broader wealth growth has led to industry introspection, with auction houses now rethinking their offerings to attract this new generation of collectors. The question many are asking: is the art market broken, or just evolving?

As luxury brands brace for continued uncertainty, it’s clear that the industry must navigate both a stratified consumer base and evolving generational tastes. LVMH’s recent results—and the market’s reaction—are just the latest sign of an industry at a crossroads.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research or consult a professional before making investment decisions.