Russian ruble has emerged as the best performing currency of 2025, surging 42% against the US dollar. As per Bank of America Global Research and Bloomberg data, the ruble’s rebound is driven by strong energy exports, capital controls, and shifting global trade ties. The USD/RUB exchange rate has fallen sharply from recent highs, marking a remarkable turnaround after years of volatility, sanctions, and geopolitical tensions.

Russian Ruble Emerges as Best Performing Currency of 2025

The Russian ruble has stunned global markets in 2025, emerging as the best performing currency against the US dollar. According to data from Bank of America Global Research, as of July 2025, the ruble has appreciated an impressive 42% against the greenback, defying geopolitical headwinds, economic sanctions, and the lingering impact of global market uncertainty.

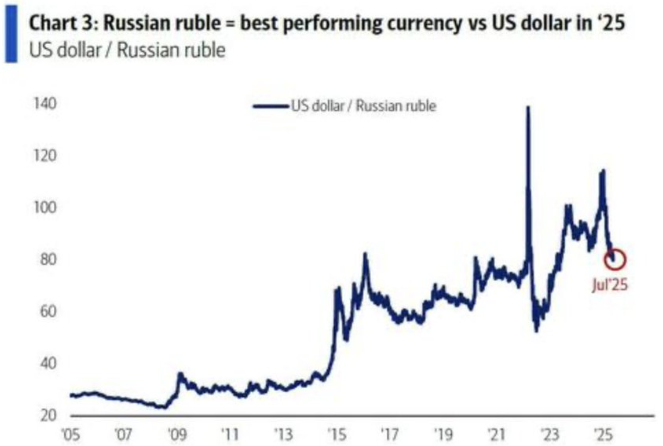

A new chart published by BofA Global Investment Strategy and Bloomberg on August 7, 2025, highlights the ruble’s historic trajectory against the US dollar over the past two decades. The data shows the USD/RUB exchange rate falling sharply in recent months, reflecting the ruble’s substantial gains. In July 2025, the exchange rate stood near multi-month lows, a level not seen since before the major spikes of recent years.

A Two-Decade Journey: From Stability to Volatility

The chart tracks the US dollar to Russian ruble exchange rate from 2005 through 2025. In the early years between 2005 and 2008, the ruble traded steadily at around 25–30 per dollar. However, the 2008 global financial crisis triggered a moderate depreciation, pushing the exchange rate to near 36 by 2009.

From 2010 to 2013, the ruble enjoyed a relatively stable period before a dramatic slide began in 2014. The sharp depreciation was driven by falling oil prices and the geopolitical shock of Russia’s annexation of Crimea, which resulted in Western sanctions. By the end of 2014, the USD/RUB rate had jumped from around 32 to above 60, marking one of the steepest declines in the ruble’s modern history.

Recurring Turbulence: 2014 to 2022

In the years following 2014, the ruble oscillated between periods of recovery and renewed weakness. By 2016, it had weakened further, breaching 80 to the dollar, before strengthening modestly. Between 2017 and 2019, the currency traded largely in the 55–70 range, supported by higher oil prices but still weighed down by persistent geopolitical tensions.

The COVID-19 pandemic in 2020 brought another phase of instability. However, the most dramatic movement came in 2022 following Russia’s full-scale invasion of Ukraine. The USD/RUB rate spiked sharply, briefly surpassing 130, an unprecedented level in the currency’s history. This spike was fueled by a collapse in investor confidence, sweeping Western sanctions, and a freeze on Russia’s foreign reserves.

A Remarkable Turnaround in 2025

Despite the historic volatility, the ruble’s 2025 performance has surprised even seasoned market analysts. As of July 2025, the USD/RUB exchange rate has fallen significantly from its early-year highs, reflecting the ruble’s 42% surge. This makes it the top-performing currency against the US dollar this year, outpacing gains in emerging and developed market currencies alike.

Several factors have contributed to this rebound. Analysts point to robust energy exports, particularly to Asia, which have bolstered Russia’s trade surplus. Additionally, capital controls and targeted monetary interventions by the Bank of Russia have helped stabilize the domestic currency market. The rise in global commodity prices has also played a role, as higher revenues from oil, gas, and other raw materials strengthen Russia’s fiscal position.

Furthermore, geopolitical realignments in 2025 have opened new trade and investment channels for Russia, particularly with countries willing to bypass the Western financial system. This has reduced demand for US dollars in certain transactions, indirectly supporting the ruble.

Market Implications and Investor Sentiment

The ruble’s unexpected surge is reshaping currency market dynamics. For global investors, this rally offers opportunities and risks. Those holding Russian assets have seen substantial currency gains, but the underlying volatility and sanctions-related restrictions still make Russian markets challenging to navigate.

Currency strategists warn that while the ruble’s performance in 2025 has been exceptional, sustainability will depend on external factors such as global commodity demand, geopolitical developments, and the continuation of capital controls. Any easing of state measures could reintroduce market-driven volatility.

For Russia, the stronger ruble has mixed consequences. On one hand, it helps curb inflation by making imports cheaper, easing the burden on consumers and businesses reliant on foreign goods. On the other, it can hurt export competitiveness if the currency’s appreciation continues unchecked.

A Symbolic Victory Amid Sanctions

Beyond economic measures, the ruble’s resurgence carries symbolic weight for Moscow. Following years of sanctions aimed at isolating Russia financially, the currency’s rally is being framed domestically as evidence of economic resilience and adaptability. State media and government officials have touted the ruble’s performance as a victory against Western economic pressure.

The July 2025 data point highlighted in the BofA chart underscores this narrative. For the first time in years, the ruble is trading at levels that show significant strength compared to its crisis periods of 2014, 2020, and 2022.

Looking Ahead

The ruble’s dramatic 42% gain against the dollar in 2025 is one of the standout financial stories of the year. Whether this momentum can be sustained remains to be seen. Economic fundamentals, global energy markets, and political developments will continue to shape its trajectory.

What is certain is that the Russian ruble’s journey over the past two decades, from the stability of the mid-2000s to the extreme volatility of the 2010s and early 2020s, has reached a new chapter in 2025. The latest rally is not just a financial statistic—it is a reflection of shifting global trade patterns, monetary policy strategies, and the complex interplay between economics and geopolitics.

As the year progresses, all eyes will remain on Moscow’s ability to manage the currency’s newfound strength and on how the ruble’s performance influences the broader global economic landscape.