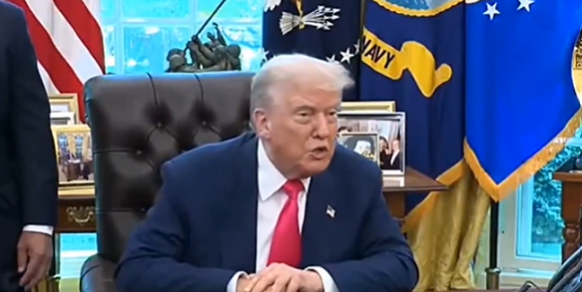

President Donald Trump has sued JPMorgan Chase over alleged political debanking while escalating his fight against high credit card interest rates, calling them usury and economic exploitation of American consumers.

Trump Takes On JPMorgan

A major confrontation between President Donald Trump and America’s largest banks intensified this week after Fox Business reported that the President has filed a lawsuit against JPMorgan Chase and its CEO Jamie Dimon, alleging politically motivated “debanking.” The lawsuit claims that financial institutions are denying or restricting banking services based on political or ideological considerations.

JPMorgan has strongly denied the allegations, stating that the lawsuit has no merit and asserting that the bank does not close accounts for political or religious reasons.

The legal battle comes amid a broader and increasingly public dispute between President Trump and major financial institutions over high credit card interest rates, an issue the White House says is harming millions of American consumers.

Credit Card Rates, Usury Laws, and Trump’s Economic Argument

President Trump has repeatedly criticized credit card companies for charging interest rates as high as 28 to 30 percent, calling the practice exploitative and inconsistent with traditional usury laws that once limited how much lenders could charge borrowers.

Speaking on the issue, Trump said that Americans who fall slightly behind on payments often see interest rates spike to levels that push them toward bankruptcy. He questioned what happened to usury laws that were designed to prevent excessive interest charges, arguing that consumers should be given time to get back on their feet rather than being buried under compounding debt.

The President emphasized that while he supports free enterprise, he believes the current system has gone too far in allowing credit card companies to profit from financial distress.

Banks Consider Lower-Rate Cards as Pressure Mounts

According to a new report discussed on Fox Business, Bank of America and Citigroup are considering launching new credit card products with interest rates capped around 10 percent. This development comes as political pressure builds and public scrutiny intensifies around credit card pricing practices.

Commentators noted that such a move would mark a dramatic shift from current industry norms, where rates commonly exceed 25 percent, even as benchmark interest rates remain far lower.

Spread Over Prime Rate Under Fire

One of the central criticisms raised during the discussion focused on the widening spread between the prime rate and credit card interest rates.

The prime rate currently sits around 3 percent, yet credit card issuers are charging spreads that have grown dramatically over time. In 2000, the spread over prime was roughly 5.5 percent. Over the past year, it has peaked near 15 percentage points. Since the early 2000s, the spread has increased by roughly 9 percent.

This expansion occurred despite changes in bankruptcy laws that made it harder for Americans to discharge credit card debt under Chapter 7. As a result, borrowers are now considered better credit risks for banks, since lenders have greater ability to recover funds even after bankruptcy filings.

Critics argue that credit card pricing no longer aligns with actual default risk or expected losses, and instead reflects profit maximization enabled by market concentration.

Jamie Dimon Pushes Back, Warns of Unintended Consequences

Jamie Dimon has argued that imposing caps on credit card interest rates would lead to unintended consequences, including reduced access to credit and a shift toward payday lenders and other predatory financial products.

Some panelists countered that these predatory rates already exist within the mainstream banking system, making Dimon’s argument less persuasive. They described current credit card practices as a form of legalized usury that extracts wealth from consumers under the guise of free-market lending.

Critics also highlighted JPMorgan’s core revenue streams, pointing to ATM fees, merchant fees, credit card spreads, and the gap between near-zero interest paid on deposits and much higher rates charged on loans.

Political and Regulatory Dimensions of the Conflict

The lawsuit against JPMorgan has also raised questions about regulatory power and political influence. Some commentators described the dispute as part of a broader negotiation strategy by President Trump, similar to his high-profile maneuvers on trade, tariffs, and even foreign policy matters such as Greenland.

Others pointed out that banks often resist government intervention by citing antitrust laws, even as they benefit from regulatory structures that limit competition.

Competition Versus Price Controls Debate

The debate over credit card rates has exposed sharp ideological divisions. Some voices argue that government should not dictate how businesses operate, instead calling for deregulation and lower barriers to entry to encourage new competitors.

The argument is that if more startups and financial institutions entered the credit card market, competition would naturally drive rates down. However, critics noted that just five or six major companies currently control the majority of outstanding credit card balances, limiting true competitive pressure.

President Trump’s supporters argue that his approach mirrors past interventions, such as efforts to reduce drug prices, which they say delivered tangible results.

Federalism, State-Level Experiments, and Practical Challenges

Jamie Dimon has suggested that states like Vermont and Massachusetts could experiment with credit card rate caps, framing the issue as a matter of federalism. Progressive lawmakers such as Bernie Sanders and Elizabeth Warren have supported such ideas.

However, practical concerns remain. Credit cards operate across state lines, raising questions about enforcement, jurisdiction, and consumer eligibility. Applying state-specific interest caps in a national financial system could prove legally and logistically complex.

Affordability, Inflation, and Consumer Behavior

Some commentators expressed concern about the President’s approach, arguing that telling businesses how to run their operations sets a troubling precedent. Others emphasized personal responsibility, advocating for credit-free living and warning that credit cards are designed to keep consumers trapped in long-term debt.

The discussion also touched on the broader economic backdrop. During the COVID period, household savings surged as spending declined and stimulus checks boosted incomes. That financial stability was later eroded by inflation that peaked near 9 percent, dramatically increasing the cost of living.

As a result, many Americans are now struggling not because of poor financial habits, but because inflation undermined their purchasing power.

Profit Versus Protection: The Core Question

At the heart of the controversy is a fundamental question: why have credit card interest rates risen so sharply relative to prime rates when default risks have arguably declined?

Critics argue that the only plausible answer is profit. They contend that banks have become more effective at extracting payments from borrowers, even in bankruptcy, yet have not passed any of that reduced risk on to consumers.

Comparisons were made to public health protections, such as restrictions on over-the-counter opioid sales, to argue that financial products can also cause harm and warrant oversight.

As President Trump uses the power of the presidency and what supporters call the “bully pulpit” to push the issue into the national spotlight, the fight over credit card interest rates, bank practices, and consumer protection appears far from over.