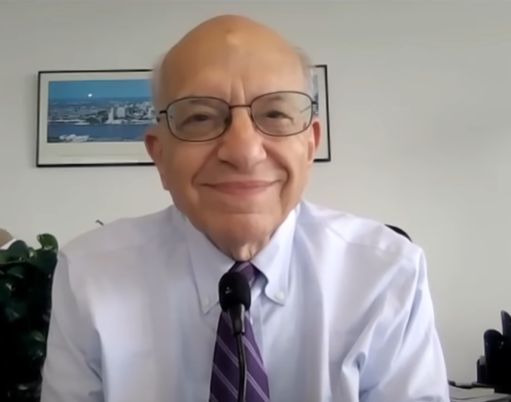

US Trade Secretary Bessent Says Powell Will Leave FED Board in May 2026

Bessent Says Powell Will Leave FED Board in May 2026: In a comprehensive interview, US Trade Secretary Bessent addressed key economic and trade issues—from the Federal Reserve’s inflation outlook and speculation around Chair Jerome Powell’s future to Nvidia’s resumed GPU exports to China. He explained how export control policies were used as leverage in ongoing …